As a report claims Tesco CEO “had to go” because his store turnaround under-delivered, The Grocer looks at how the wheels came off…

When Philip Clarke launched his £1bn ‘Building a Better Tesco’ programme in April 2012, he could surely not have envisaged how much the UK’s most powerful retailer would struggle to “refresh” the physical elements of its empire.

As the dust settles on Clarke’s impending exit, a look back at the store refurbishment programme reveals a series of crucial setbacks, which not only saw the programme suck money from Tesco’s dwindling profits but also delayed the potential massive gains of launching much improved stores to an expectant public.

A year into the programme The Grocer first revealed that the retailer had fallen way behind schedule in the store programme.

Instead of the 430 “refreshes” planned in the year that had gone, just 300 of the UK stores had been revamped.

“What became clear is that some of the larger stores were going to need more work than had originally been planned,” said a Tesco spokeswoman at the time.

Clarke said the new features were transforming stores and Tesco was determined to speed up the revamp, explaining that 70 large stores were in the pipeline for refurbishment that year - though this still represented a shortfall on its original target.

Yet by October 2013, the story had got little better when it came to the big sheds - which the exodus to online was threatening to make redundant.

Tesco admitted then it had still only revamped eight hypermarkets, and while prototypes in Watford, Coventry and Purley, provided a major wow factor for those who visited, they were still the exception not the rule.

Clarke acknowledged that the Extra rollout had been stuck in the slow lane for too long but he vowed that 2014 would be “the year of the hypermarket”. The CEO said Tesco would refresh 60-75 Extras in 2014 and later upgraded this prediction to 110.

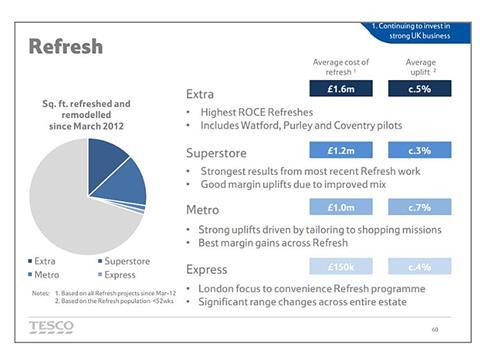

Tesco also revealed what for the retailer was hugely transparent data to show just why it wanted to speed up the process.

The chart bellows shows how the Extras that had been refreshed were seeing average sales uplifts of 5%, more than the impact of refreshes of Express stores or superstores and only outstripped by the average 7% uplifts of Metro revamps.

Yet as of 24 February, nearly two years into the programme, it has still only refreshed 82 Extras, leaving two thirds still to be refreshed, which is expected to cost more than £260m.

| To date | Refresh roll-out | |||

|---|---|---|---|---|

| Format | Total number of stores* | Refresh stores | 14/15 | Ongoing per year |

| Extra | 247 | 82 | c.110 | c.60 |

| Superstore | 482 | 178 | c.50 | c.100 |

| Metro | 195 | 46 | c.40 | c.50 |

| Express | 1,672 | 309 | c.450 | c.375 |

| Capex | c.£400m | c.£500m | c£500m | |

*as at 24 February 2014

Tesco was also unusually frank about how it was overexposed to the problems facing large stores, with more than half of its space 50,000 sq ft.

For example, Tesco admitted that compared to Asda it has twice as much space allocated to consumer electronics, one of the sectors most deserted by shoppers in favour of the web, whilst it had half as much space allocated to clothing.

% of retailer space by store size (excluding stores <10,000 sq ft):

| 10-30k sq ft | 30-50k sq ft | 50-70k sq ft | >70k sq ft | |

|---|---|---|---|---|

| Tesco | 20% | 24% | 27% | 29% |

| Competitor A | 8% | 29% | 39% | 24% |

| Competitor B | 22% | 35% | 30% | 13% |

| Competitor C | 28% | 62% | 10% | 0% |

| Competitor D | 88% | 8% | 4% | 0% |

Come its annual report in May, Tesco wrote how the untouched larger stores were becoming a major “drag on performance”.

“Therefore, the focus of our refresh programme will now be on reinventing our largest stores to ensure that they are worth the trip for customers,” it said.

It vowed to roll out “more of the ingredients” from the likes of Watford, with strong clothing, a new range of general merchandise as well as tailored new food experiences, such as Giraffe, Euphorium, Harris+Hoole and Decks.

“We are looking forward to accelerating the appearance of these new features in our stores over the next three years,” said the report. “While this refresh work causes some short-term disruption, the resulting uplifts will be long-lasting.”

When in June he blamed Tesco’s dire Q1 results in part on the impact of the store programme he had initiated more than two years earlier, patience among many shareholders began to run out.

Tesco still says it is on course to refresh 650 stores by the end of this year and finishes its entire estate by 2017.

It even sounded positively upbeat two days after Clarke’s departure was announced, declaring that the Broadstairs and Addlestone Extras were the latest to have been revamped, following others in recent months such as Lincoln and Slough.

Sadly for Clarke, it was all too late.

No comments yet