As Dave Lewis served up a new year surprise for the many Bah-Humbuggers in the City who had been busy sharpening their knives for the Tesco boss, it was illuminating to look back at the ghosts of the retailer’s Christmases past.

Tesco today announced a 1.3% growth in the six weeks leading up to January 9. This, coincidentally, was two years to the day since the fateful profit warning that proved the beginning of the end for his predecessor Philip Clarke.

The contrast is pretty stark and will give the new management a considerable sense of vindication, especially after the lack of faith from investors – and many commentators – which saw Tesco shares plummet in recent weeks to near 20-year lows. It must have been a nerve-shredding time for Lewis and his team.

Today more than one analyst described Tesco as “blowing away expectations”. Despite what we must not forget was a 1.5% fall over the full course of Q3, group sales over the quarter increased by 0.4% - the first reported increase for over four years. Compare and contrast with Clarke’s reign, where a steady stream of bad news turned into a flood, 24 months ago, when Clarke had to admit that that fateful £150m profit warning.

What also jumps out is the way Lewis has changed the conversation back to retail basics and away from online.

The positive news today was all about old school metrics – availability was 4% higher than a year ago, customer satisfaction was up 4%, prices were 5% cheaper on Christmas fodder and up to 2.5% cheaper across the wider range.

As for digital, click & collect deliveries… not a single mention.

Asked by The Grocer whether this was a coincidence, Lewis admitted he had carefully thought about what to include in the results, adding that Tesco was “being economically more sensible and pricing in the level of service” in its online operations.

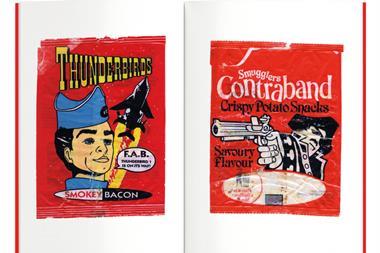

Two years ago, on the other hand, Clarke spoke of the “further consumer shift towards multichannel retailing” and highlighted Tesco’s leading role in the digital space. He spoke of the three million online grocery delivery orders, Tesco’s 1,700 click & collect locations and, of course, the Hudl (remember that?).

Clarke’s multi-channel plan smacked of hope over expectation and also of going into the unknown without a strong battle plan. Whereas today’s figures, while by no means proof Tesco is out of the woods yet, were all firmly pinned against a solid set of ambitions Lewis laid out a year ago.

Back then, of course, the Tesco boss had to confront a massive programme of store closures and redundancies and he still has major challenges ahead, not least how Tesco responds to that shift to online in the longer term.

But while Amazon may be lurking in the wings for another day, Lewis’ first priority is doing the basics, the ABC of retailing, taking on Aldi and Asda. And for now, at least, it appears he may be winning.

No comments yet