Few companies split opinion more in the grocery sector than Ocado.

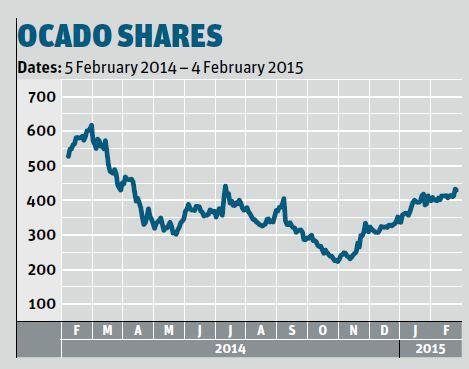

The online grocer would have been forgiven for believing it had proved the doubters wrong with its first annual profit on Tuesday morning. But Ocado’s share price continued its recent volatility as the City struggled to know what to make of the non-traditional retailer. The market’s reception to Ocado’s full-year figures illustrates the point - the shares fell 5.7% to 390.9p moments after opening on Tuesday, only to shoot up to end the day a healthy 4.7% up to 435.2p. On Thursday the roller-coaster was back on the way down, falling 5.9% to 406p after a ‘sell’ downgrade by Deutsche Bank.

Brokers are as split on the stock as the rest of the market. Clive Black of Shore Capital, a long-term seller of the stock, said: “In due course, much-feted international commercial relations are expected to come through… but the question for us is whether or not such developments have substance and can they move the profit, earnings, cashflow or returns dial of the group?”

Andrew Wade of Numis was more bullish, arguing: “Ocado is uniquely positioned to leverage its market-leading IP to support Ocado Retail and develop partnerships with global grocery retailers”. Current broker target prices for the stock range hugely, from 260p to 680p.

European Coke bottler Coca-Cola HBC also had a volatile week as market sentiment on the Greek economy shifted with the wind. The FTSE 100 constituent, which has a secondary listing in Athens, had fallen by almost 13% in 2015 given concerns over the Greek economy in the run-up to last week’s election. As belief spread the financial plans of the new Greek government were not as radical as some had feared, the shares rose 3% on Tuesday to 1,104.6p, but the company was back down to 1,065p on Thursday morning.

Elsewhere, AG Barr ended the week flat after its investment in the out-of-home sector. On Monday it announced a £21m acquisition of fruit purées, mixers and syrups maker Funkin, but its shares remained unmoved at 640p early on Thursday.

Sign in to comment on this article

Not logged in before? Register for FREE guest access today.

You will be able to:

- Read more stories

- Receive daily newsletters

- Comment on stories

Advert

No comments yet