The proposed merger of Booker and Tesco is very big news for the smaller store end of British grocery retail. For Tesco it is not structurally transformational. Its £55bn of group sales are over 10 times that of its new partner. However, for Booker is it the end of the road of the marvellous journey that started with its emergence from the somewhat comical Big Food Group and the reversal into Blueheath? Booker has great management, a balance sheet to die for, marvellous cashflows and so a premium stock rating.

So what do we think? Well, first and foremost, Tesco is paying a very high value for such a premium rated stock in 0.861 new shares and 42.6p of cash; c25x earnings and 17.5x EBITDA, so no quick payback. Capital discipline? Secondly, for Tesco, sustaining a theme, this deal does not fundamentally deal with the key structural and operational issues within the business: seeing through the fix of the UK, making online profitable, growing Central Europe and materially deleveraging. Thirdly, this deal could introduce a lot of regulatory process distraction.

The UK CMA is a law unto itself. Within this proposed merger it will potentially be absolutely constipated by postcode analysis. Elements of the wholesale trade may be in uproar and Booker may have opened a wound in a fabulous armoury that makes it vulnerable to regulatory risk and competitor attack through a referral process.

We will watch with interest to see how the CMA views the small grocery store and convenience market through the eyes of this merger, particularly whether Tesco-Booker can keep Express, One Stop, Budgens, Londis, Family Shopper and Premier. Suggesting that Booker not owning stores makes a big difference here may be questionable. Quite what remedies, if any, emerge therefore remains to be seen, but a Phase II investigation à la Poundland/99p with no remedies may not be plausible.

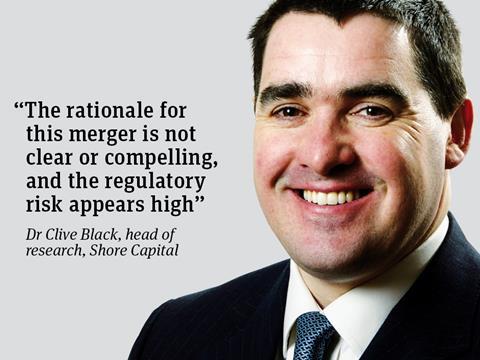

We hold Dave Lewis and Charles Wilson in huge regard. Richard Cousins too. We respect their track record, expertise and judgement. The rationale for this merger, however, is not clear or compelling to us and the regulatory risk appears high.

Full crop utilisation and greater carbon effectiveness seems to clutch at straws. The process could be a very interesting ride.

Clive Black is head of research at Shore Capital Stockbrokers

No comments yet