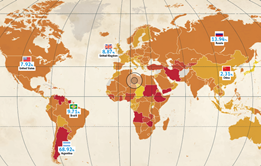

Consumer goods multinationals are having to recalibrate their geographic growth strategies as the Chinese economy shows signs of slowdown.

The 2010s saw fmcg groups compensate for slowing growth in developed markets by tapping into booming consumer demand and the growing wealth in emerging markets, particularly China.

But post-Covid, China’s growth has slowed significantly, with only 0.4% GDP growth in the second quarter of 2022, and the gap between its growth and the rest of the world forecast to normalise.

China has been slower to recover from Covid amid tight restrictions, but structural challenges are also affecting the country: a declining working-age population, a slowdown in urbanisation, increased labour costs and a gulf in income inequality.

Additionally, geopolitical matters – notably the hangover from the US-China trade war and concerns over its relationship with Taiwan – have driven increased volatility in the country and region.

“A lot of businesses were using strength in their heartland plus a growth story in China to support their overall outlook,” says OC&C partner Claire Dannatt. “Now China fundamentally carries a greater risk and a little less reward, and they will have to think where else that growth can come from.”

The most obvious example is Reckitt’s retreat from China. But China-based WH Group has also attempted to reduce dependency on its home market over the past year, increasing investment in the US and Mexico and reducing its proportion of domestic sales.

Jefferies analyst Martin Deboo suggests the slowdown in China “is having more impact on the beauty industry than the staples industry”, noting Covid regulations are returning expenditure on staple products back to the home, potentially supporting brand consumption.

Additionally, he notes China still has a finite impact in global consumer goods as, although it’s a significant growth market, it typically represents a mid-single-digit proportion of turnover.

Although the Chinese economy has slowed, it is far from in recession, Dannatt adds: “China will remain one of the fastest-growing economies in the world, so there is still opportunity there. It likely requires a more balanced approach along with other opportunities and geographies.”

OC&C Global 50 food and beverage rankings: how fmcg giants are tackling inflation

The world’s fmcg giants survived the pandemic. Now they’re facing into rampant inflation. Are they agile enough to handle rising costs, changing shopper habits and geopolitical volatility?

- 1

Currently

reading

Currently

reading

China’s role in the global post-Covid market

- 3

No comments yet