A craft-based, artisan-inspired gin renaissance has seen sales of gin soar. But is there a risk some producers are cutting corners and hiding behind ‘artisanal’ and ‘hand-crafted’ labels to make a fast buck?

Mother’s ruin has had a serious makeover. In beautiful bottles, with ornate calligraphy on the labels and elaborate wax seals and other luxury goods packaging, hip, oft-bearded producers of artisanal, small-batch ‘hand-crafted’ brands are delivering some stunning gins. And consumers are lapping it up.

The figures are astonishing. Value sales of gin in the off trade grew by a gargantuan £146m (31.8%) to £604.6m over the last year. That’s almost 30 million litres [Nielsen 52 w/e 30 December 2017]. In Britain’s pubs and bars, gin sales also surged 19% to 61,000 hectolitres - the equivalent of 8.8 million bottles, worth approximately £729m, [WSTA 52 w/e 9 September].

Gin in numbers

49

The number of UK gin distilleries that opened in 2017. There are now 315, double the number in 2012

1.32bn

Number of gin & tonics the nation drank, based on bottle sales, in the 12 months to 9 September 2017, according to WSTA figures

£604.6m

Off-trade sales of gin in 2017 [Nielsen]

180m

Number of bottles of gin exported from the UK in 2016

Gin’s flying abroad, too. Exports hit £474m (around 180 million bottles) in 2016, making it the world’s seventh most valuable food and drink export [WSTA].

Indeed, as the spectre of Brexit looms ever closer, even politicians are touting gin’s fortunes as reassuring proof of Britain’s entrepreneurial spirit. Take Brexiteer Stephen Woolfe MEP, who this month gifted a bottle of Hendrick’s to chief EU negotiator Michel Barnier in a hamper of products designed to demonstrate Britain’s food manufacturing prowess.

But there’s a darker side to Britain’s gin boom. Behind the headline-grabbing sales figures, worries are mounting in the industry that consumers are being taken for a ride by brands charging extortionate prices for sometimes low quality liquids disguised by clever marketing.

So is there any merit to these claims? What’s the markup on these gins? What exactly is a craft gin? And just how easy is it to make one?

While the flourishing gin scene has been attributed to a number of factors - including an Instagram-fuelled cocktail renaissance, better mixers (hat tip to Fever-Tree), and gin’s variety and versatility versus vodka and whisky (the sheer number of potential botanicals and flavourings means every gin can, in theory, taste different) - it’s also a lot easier, quicker and cheaper to make than many spirits.

A perfectly palatable gin can be created in a matter of days. In contrast, whisky requires a minimum of three years maturation before it can even be called whisky. Rum - tipped as the next big thing - is also expensive and fiddly, with notoriously low yields. As to vodka, it’s relatively quick to make, but tasteless too: it’s essentially the process of adding flavourings and botanicals that turns vodka into gin.

The cost of gin depends partly on the scale of production but the process is crucial, too. There are two schools: distillation or cold compounding. Distilled gin, as a rule, requires pricier kit (a still), whether distilling the alcohol (grain-neutral spirit in most cases, which is essentially vodka) from scratch or buying it in from a larger supplier, before redistilling in flavours and botanicals.

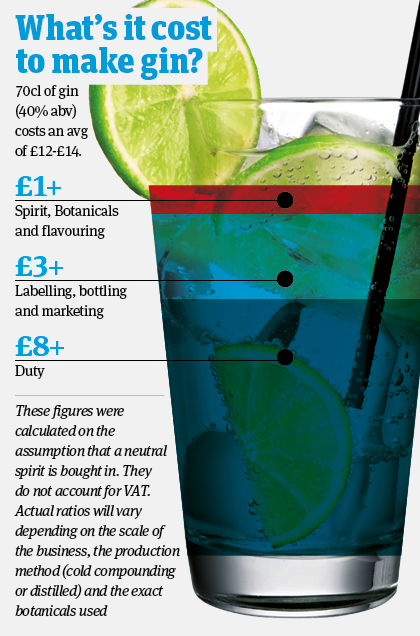

What’s it cost to make gin?

- Spirit, botanicals and flavouring: Prices of grain-neutral alcohol can fluctuate, as it is a natural product and a commodity, but the aptly named Alcohols Ltd, one of the UK’s largest sellers, says it sells for as little as £1 per litre. “The liquid that goes into the bottles is actually the cheapest element in a gin,” says group commercial manager Natalie Wallis. As to flavourings and botanicals this is hard to measure, given the sheer variety of different gin recipes but they tend to be a very small cost. In reality, the amount you need for a batch of gin is not that great.

- Labelling, bottling & marketing: Making your product look the part can be relatively pricey. “We know with brands we’ve produced and brought to market that it’s often these that are the most expensive parts,” says Wallis. A growing number of brands are choosing to outsource production, freeing up resources to focus on marketing and sales. Alcohols alone produces more than 200 gins for different businesses.

- Duty: Tax is by far the biggest cost to many brands. UK spirit duty is currently set at £28.74 per litre of pure alcohol - that’s £11.50 per litre of gin at 40% abv, or £8.05 for a 70cl bottle, rising according to the strength of the liquid (up to 76% in the case of Strane).

Having said that, even distillation can be done on the cheap these days: there are a growing number of home stills, small enough to fit in the average bathroom, available for less than £150. Indeed, says another insider: “A lot of consumers are drinking batch-bought neutral spirit from a big distiller that has been run through a pot still bought off eBay for less than the price of a decent pair of trainers.” Redistilling with such kit requires a rectifier’s licence from HMRC, but the taxman has no powers to refuse one - it’s a simple formality, putting production well within the means of a vast swathe of amateur booze makers.

Cold compounding, on the other hand, requires no distillation or heating equipment at all - just botanicals and flavouring along with the base alcohol, which can be bought for as little as £1 per litre - and the increasing use of this process to make gin is a cause of growing concern.

Fresh orange juice versus squash

“The difference between distilled and compound is like fresh orange juice versus orange squash,” says Liam Higgins, co-founder of Spirit Valley France. “One is created from a balance of original, natural source material, the other by adding concentrates to an alcohol base and giving it a stir. The simplicity of compound gin production and low material and infrastructure cost are driving factors behind the gin boom.”

That and the fact that it is not immediately obvious which process was used. So a gin can be sold at a premium of £45 or higher, on the basis that it’s hand-made, even though it’s cost peanuts to make.

So what’s the punter to do? “If I were giving a friend quick advice, I’d suggest they stayed away from gins that didn’t display their defining provenance, of distillation or compound production,” adds Higgins.

The traditional argument for distillation is that heating extracts the essential oils of juniper and other botanicals to a higher degree, while compounding risks a weaker flavour that can fade over time.

Not everyone agrees distillation is a superior production method, though. Some award-winning tipples, such as Ableforth’s Bathtub Gin, wear their compound credentials with pride.

“We’re 100% proud of our process and the gin it produces,” says Ableforth’s global brand manager Adam Wyartt. “It takes a lot of time and effort to put together our cold compounded gin. To say one kind of gin is better than another is a fairly nonsensical argument. You may buy a London Dry you absolutely hate, compared to a compound that really suits your palate.”

So, a case of trial and error, then? Nicholas Cook, director general of The Gin Guild, dislikes the disingenuousness of a number of brands that are “jumping on the bandwagon, using cold compounding, and describing it with some fairly cunning wording”.

Is distilled gin always better?

Terms like ‘hand-crafted’ and ‘artisanal’ are particularly rife in modern gin packaging, but while they give the impression of quality they “really mean nothing” says another source. “All ‘handcrafted’ or ‘hand bottled’ means is that a person has filled them up by hand or someone dipped a bottle in wax or fastened a label.

“Shops are saturated with lifestyle hobbyists making a margin on getting a good designer in and someone to market it at foodie events. They have compelling brand stories and beautiful packs. But they are making a buck at the expense of people’s naivety.”

Many gins are now selling at “extraordinary” prices says Cook. While a bottle of Gordon’s or Beefeater comes in at around £14-£18, it’s not uncommon for artisan gins on sale in the supermarkets to retail above the £35 mark, with online retailers stocking gins ranging up to the low hundreds.

“They are allowed to do this, of course, but people might be surprised to realise there is a fundamental difference in terms of cost, overheads and production. They are probably no more naïve than if they were buying a pair of branded trainers against a pair of unbranded trainers made by the same poor child in India. But if they knew the difference perhaps they wouldn’t be prepared to pay for it. It is a marketing triumph.”

Ableforth’s Wyartt disagrees, and points out emerging brands using cold compounding are helping drive value into the category. “Cold compounded gin is an incredibly broad church, and [is delivering] an exciting level of innovation. Innovation is a sign of a healthy category, and I think one would be ill-advised to try and stifle that. You could make a case that anything of a sufficient quality deserves a certain price point.”

A lack of transparency about the method of production is one thing, though, and wilful deceit quite another, adds Cook. “If you were to go round the country and look at the number of people who claim to be distillers, many of them don’t distil in any shape or form. It’s very irritating for those people who have actually lobbed out the money, time and expertise.”

Trading Standards are keen to crack down on the worst offenders, who cold compound gin and try to pass it off as a distilled product on their websites and packaging, he warns. “If they mention the word distilling and there are pictures of stills on their website, they will be taken down.”

Keeping quiet

Despite this mounting frustration, however, sources are unwilling to point the finger at any specific brands, which makes attempting to gauge the scale of the problem difficult. One insider claims those who know just how disproportionate some prices are have become “unwilling to say what is happening because in every sense there has been more to gain from keeping quiet”.

With the market growing at such a remarkable pace, it’s understandable why many may want to avoid raining on gin’s parade.

And it’s worth pointing out that while craft gin has created a lucrative little niche for itself, big players such as Diageo and Pernod Ricard still account for the majority of new gin sales. Gordon’s is still the nation’s favourite by a long shot, boosting its sales by 11.3% to £188.9m this year alone. Diageo’s Tanqueray (50%), William Grant’s Hendrick’s (27%), G&J’s Opihr (108%) and Bloom (143%) and Halewood’s Whitley Neill (210%) are also in healthy growth. And the bestselling new gin to hit the market in 2017 wasn’t a trendy, small-batch concoction, but the unashamedly accessible Gordon’s Pink, which has racked up a stunning £17.1m since its autumn launch [Nielsen].

“They have compelling brand stories and beautiful packs. They are making a buck at the expense of people’s naivety”

Some believe stricter regulations should be brought in forcing gin brands to specify the technique used. Some even want to draw a dividing line between brands that distil their base spirit in-house and those that buy it in before rectification, let alone those that cold compound. “There really should be full disclosure on rectification and distilling licences so the consumer can make an informed choice,” says one source. “If you are drinking something and you think it is something else then that means you are being misled.”

Doug Bairner, MD of craft beer behemoth BrewDog’s spirits arm LoneWolf, believes honesty is the best policy. “We 100% understand that smaller producers have less to work with and applaud anyone who makes a great tasting product with whatever they can lay their hands on. All we’d ask from anyone is to do it in a way that is open and honest. We’d bet consumers would love them even more for it.”

Not the enemy

But small producers are not the enemy, Bairnier argues. Rather than focusing on a handful taking the mick with their pricing, he suggests an increasing number of unnamed “big producers” with “bags of cash” are “deliberately taking short cuts to make a very profitable but distinctly average liquid [despite using the distillation process], implying it is ‘craft’ and relying on big budget marketing and promotional campaigns to sell it”.

Many in the drinks industry are likely to feel a strong sense of déjà vu if arguments about the ‘craft’ credentials of gin brands grow louder. The beer world is still aflame with disagreement as to whether the likes of Camden Town Brewery or Lagunitas can still be called ‘craft’, having been bought by AB InBev and Heineken.

And even if clearer labelling were introduced, it’s unlikely many consumers would shun gin brands based on anything as esoteric as distillation technique - especially considering the amount of shelf space dedicated to gin in the mults following range reviews over the last year, which has put a vast selection of brands in front of an ever-growing number of shoppers.

More likely, the sheer proliferation of sub-scale brands in the market could eventually tip the balance back towards established players with sizeable marketing budgets. “You have a hell of a challenge getting your product to market now,” says Cook. “When you take your bottle to a distributor, assuming it tastes and looks good, they’re going to ask you why it’s different and why they should stock it against what they already have. Because there is a limit.”

Ultimately, Cook predicts a thinning of gin brands on shop shelves may be on the cards. “It will be the ones that have an excellent back story and got to the market early enough that survive, such as Sipsmith, Cotswolds Distillery, Hayman’s and The Lakes Distillery.”

That means lower-quality gins should in theory begin to drop off. Trouble is, good ones could get taken down with them.

Just how easy is it to make a craft gin?

It’s only fair we have a crack at it ourselves. We use Sainsbury’s own-label vodka (£11.50/70cl) as our base spirit, and a gin-making kit from Sandy Leaf Farm (Amazon £7.99). Total investment: under £20.

By day four, the liquid is resembling a light whisky. Or wee. This is due to the orange and lemon peel in the pack infusing directly into the alcohol, (which would not happen if added via redistillation). After a week, a pleasant, gin-esque smell is coming through, and the liquid has turned darker. After three more days I sample it.

Verdict: The Grocer’s gin is unlikely to win any awards, but it’s not bad for a first crack. Now, if only we had some posh tonic and a slice of lemon in the office…

No comments yet