Distracted by an expansion opportunity, management ‘took their eye off the ball’ as a crisis was developing in the customer offer

Exactly two years ago, Poundland announced the “biggest transformation of its store estate in its 32-year history”, with 50 shops to open in nine months, creating up to 800 jobs.

It was performing robustly, some way into the financial year that ended in September 2023 with same store like-for-like sales up 5.6%.

But now Poundland has run into serious trouble. Its like-for-like sales fell 3.6% in the year to 30 September 2024, leading to a £650m writedown on owner Pepco Group’s balance sheet, reflecting the value of its investment when it acquired Poundland in 2016. It drove a £560m net loss for the Warsaw-listed group, which blamed Poundland’s “weak performance”.

Things got even worse over Christmas, with Poundland like-for-likes down 7.3% in the three months to 31 December, the quarter one update revealed.

Drastic action is now being taken. Sky News reported last weekend that Pepco Group had formally engaged consultants AlixPartners to explore options for turning around Poundland’s performance, raising questions over a possible sale.

And The Grocer revealed this week that Barry Williams had returned in a supervisory role on an interim basis to run a comprehensive assessment of Poundland, two years after leaving as MD.

So, what has gone so wrong for the 825-store chain? And what does it need to do?

Back in 2023, Poundland was looking for more large units in retail parks, having opened bigger and bigger ones since the pandemic – up to 19,000 sq ft.

More space was needed after expansion into new categories. It rolled out clothing across its estate in 2019 and launched a more ‘luxury’ home range in 2020. It also added frozen food with the acquisition of Fultons in 2020.

When Wilko collapsed into administration in August 2023, it presented a further chance to step up its expansion.

“Management would have been excited. Sales were going up because there was more space. And they took their eye off the ball of the underlying business,” says a source with knowledge of Poundland.

At the same time, a crisis was developing as Poundland switched to sourcing at group level through Pepco, first for clothing in September 2023 and then GM in March 2024.

In clothing, there were not enough sizes in the new range and “it further became clear that our UK customers had a different expectation of the Poundland brand proposition compared with Pepco customers”, the group later revealed in results. In GM there were “gaps in seasonal ranges” and other areas of historical strength for Poundland, including DIY.

The full-year results also revealed that “larger stores are not where Poundland delivers best”, with sites of around 7,500 sq ft to be the new focus.

Fmcg, a least, was still in like-for-like growth, of 1.6%, despite “increasing competition from the larger format retailers during the year”. Revenue was flat, at £1.7bn, despite Poundland’s estate growing by 13 stores.

By the end of quarter one, however, fmcg had also slipped into negative LFL, despite Poundland cutting essentials like bread and milk to £1 in December under the new slogan ‘Home of the Pound’. The store size point was rendered moot as the group put the brakes on expansion.

Poundland has now leant further into the ‘£1 or less’ strategy this year, increasing the number from 1,500 to 2,400 – about half its core range.

The Wilko distraction

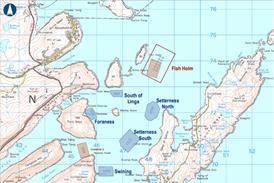

12 September 2023: Poundland agrees to take the leases for 71 former Wilko stores following the retail chain’s collapse into administration in August.

30 September 2023: The first 10 stores reopen under hastily added Poundland branding as the company strives to give jobs to former Wilko workers, ahead of a planned proper makeover in 2024.

7 November 2023: Poundland has now reopened 56 former Wilko stores, in what it calls “the largest three-month growth programme in its history”.

24 April 2024: The Grocer reveals that nine of the reopened stores have closed again. A spokesman blames “varied reasons”.

30 September 2024: Poundland opened 84 stores in its latest financial year but also closed 71, including some near a converted Wilko. The performance of Wilko conversions was “mixed”, with some “operating above expectations” but others needing more investment to bring the “feel and product proposition in line with the Poundland offer”, Pepco Group said.

Tough competition

GlobalData retail analyst Sophie Mitchell says: “The failure of its GM and clothing range has likely been due to a lack of marketing and the popularity of value clothing ranges in the UK from the grocers and Primark.”

The recent decline in GM shows Poundland has also “failed to entice consumers away from other discounters and the grocers”, she says.

Mitchell believes B&M also seeing like-for-like decline (of 2.8% in the 13 weeks to 28 December) points to “shoppers utilising grocers’ price-matching schemes and trading back up as they start to see signs of real wage growth”.

However, our source rejects the notion that Poundland’s problems are market-driven. They point first to the shedding of its UK buying team in preparation for sourcing from Poland, as well as the proliferation of new price points with the addition of new categories. “It was fine when it added £2 and £5 [in 2017], but it’s become a generic multi-price value retailer, while losing a bit of the secret of why people went.

“There used to be a lot of discipline in that buying team around the £1 price point. They would go to suppliers for make-to-order products that worked at that price, with margins that worked. They would do different pack sizes.

“It meant they designed huge numbers of products that were perfect for the £1 customer. And they built customer loyalty.”

Read more:

-

Barry Williams returns to Poundland to address crisis

-

Poundland owner reportedly appoints City advisers to explore options

-

Poundland’s theft clampdown was hinted at in its results. What else is on the way?

-

Poundland returns to £1 price point roots in a bid to get trading ‘back on track’

The new Pepco ranges then “really discombobulated customers” and were “so large they had to shrink the fmcg proposition, even though grocery is one of the reasons people go”.

Marc Houppermans, executive partner at Discount Retail Consulting, says: “It is important for a discounter to develop at a step-by-step pace, not losing the core of the format.”

Despite the speculation, our source does not believe a sale is a realistic prospect. “Nobody’s going to buy it like this.

“I can see how they got here,” the source adds. “Pepco is a much more clothing & home orientated business in a fast-growing market in Poland. It’s a totally different business which wouldn’t work in the UK because of established players like Primark. And Poundland, operating partly in grocery, doesn’t fit. So, what do you do?

“My hypothesis is somebody thought: ‘We’ve got to get some synergy. Let’s get rid of the buying team and push some of the Pepco stock in.’ Without checking that anybody wanted any.”

Hiring AlixPartners will give Poundland a “turnaround skillset”, which it needs.

“The business was successful, and nothing has changed except product and range,” says our source. “But you have management that was primed for growth, and suddenly trade is in freefall. That is a different skillset.”

Williams also has turnaround skills, having been parachuted in as Pepco MD to address underperformance.

There is another problem for Poundland, with FY results revealing the annual cost of shrinkage had soared 30% in two years to over £40m. Last week it announced its “biggest ever investment” in tackling the issue, including more guards and tech in stores.

“Clothing was a big mistake and probably helped create the shrinkage problem,” says retail analyst Nick Bubb.

Chris Edwards Sr, founder of Poundworld and now chair of One Beyond, has some simple advice: “The shoplifting challenge is huge. Poundland has a lot of self-checkouts and that encourages it. We’ve never fancied them.”

For the wider issues, “I’d be looking to turn around the business, or at least arrest the fall, before taking other options,” says our source. “You could cut costs but it’s not a cost problem, and you risk entering a death spiral by taking out space.

“It’s a challenge and I don’t think they know what to do.”

Perhaps Williams, with his knowledge of Poundland in more successful times, will have the answers.

No comments yet