The availability and cost of labour is of course a huge concern in the industry currently. The pressure is being felt in farming, in factories, across lorry fleets and in stores. The short-term impact can be ugly – lower availability and stock levels, depressed sales and rising costs. But there may be one big long-term implication. If the going rate for labour in our industry is reset permanently at a higher level, we will inevitably see food price inflation follow. Shoppers will notice their bill increasing and will start to stop and think a bit more about value, about where they shop and what they choose to buy.

So what should companies in our sector expect if inflation takes hold?

First, discounters are likely to gain new momentum. Aldi, Lidl and maybe even the newcomer Mere. Also Home Bargains, B&M, Poundland, Wilco and the like. Now more than ever, suppliers need to focus time and energy on these operators but in a way that doesn’t jeopardise their business with what we used to call the big four. Tesco, Sainsbury’s, Asda and Morrisons remain paramount for most suppliers, and will expect their mass to be recognised in pricing and service.

Second, within that big four, there will be an even more intense focus on price and value competitiveness. This will mean renewed attention on own label including value/farm brands, but also on big brand pricing, promotions and possibly larger packs at better value. It makes sense for suppliers to be planning for this before they are asked by retailers. Any ideas that can help retailers compete on value are going to get a good hearing.

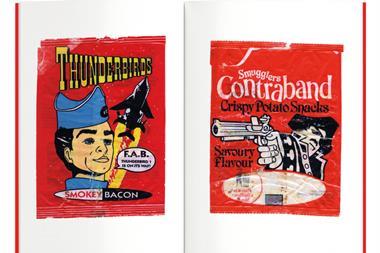

Finally, inflation will put real pressure on established price thresholds, especially promotional prices – for example, the ‘one pound’ price so common in many categories for promotion (think biscuits, crisps, chocolate confectionery). Will we see further ‘shrinkflation’ potentially leading to ridiculously small pack sizes, where the packaging almost outweighs the contents? Or will the industry finally have to move away from those price points? This would make a lot of sense for category growth, but there always seems to be some supplier or retailer who needs the volume so badly that they will keep doing it. Companies will need to be thoughtful and watchful about their approach, as these thresholds come under pressure.

Arguably, there has been a reduction in hostilities around price as the industry has focussed on the other, immense challenges of the Covid era. But if inflation does kick in sharply, those hostilities will resume, and the battle will intensify. Companies need to be thinking about this now.

No comments yet