It’s that time of year when supermarkets like to put innovative culinary twists on classic Christmas fare. Waitrose has put bacon in our trifles. Sainsbury’s has hidden a cherry in its Taste the Difference Christmas pudding. And Lidl’s gravy now comes with hints of xylene.

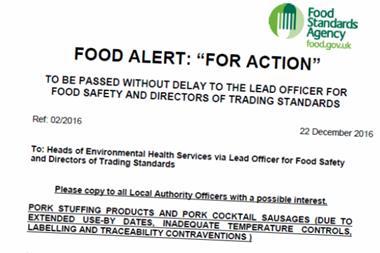

The presence of a paint-thinning chemical in Kania gravy granules was, of course, not a risky gastronomic experiment on Lidl’s part. The mistake at its British supplier prompted the discounter to swiftly issue a recall of the two affected batches at its stores on 5 December, followed by a public recall by the Food Standards Agency this weekend.

The actual fallout has been relatively mild. Aside from one report in The Independent this morning, no one has come forward claiming illness as a result of ingesting the gravy granules.

But the incident has generated reams of unwanted press coverage at a particularly crucial time for the discounter. The grocers commenced their Christmas price wars in earnest last week as Tesco brought back its ‘Festive Five’ offer on vegetables – slashing prices to 39p each. Aldi and Lidl went one step further by running 19p and 29p offers respectively, while Asda made a “massive” price cut on 500g sprouts, 1kg carrots, 360g broccoli and 500g parsnips, all now 20p.

Just this morning, Lidl sent out a press release detailing how you could feed a family of four for the entire Christmas day at under £70 by shopping at its stores. Luckily, the recommended gravy was not Kania (Bisto granules retail at just 99p) but the xylene warning may nonetheless deter bargain-hunting consumers.

The scare also risks undermining Lidl’s long-running campaign to highlight the quality of its produce. The #LidlSurprises ads – the most recent of which focused on its free-range turkey farm – have successfully hammered home the message that low prices don’t equal low standards. That its gravy contained a #LidlSurprise of an altogether different nature may resurrect old doubts among some shoppers over the discounters and their rock-bottom prices.

The furore is unlikely to halt the growth of Lidl – or Aldi – in the long run. Although Kantar data showed Lidl’s growth had slowed to 5.7% in the past 12 weeks, its £1.5bn three-year UK expansion plans will undoubtedly see it eat further into the grocery sector. But for this Christmas at least, the gravy scare is likely to have the big four rubbing their hands with glee.

No comments yet