Fmcg profit warnings have slowed significantly in the first half of 2023 as retailers and manufacturers experienced a positive start to the year, according to new data released today.

Overall, UK listed companies within consumer staples – including supermarkets and producers – recorded just six warnings in the six months to June, down from 19 in the same period of 2022, EY-Parthenon reported.

FTSE retailers issued five profit warnings during the second quarter, taking the total for the half to 10, compared with 16 a year ago.

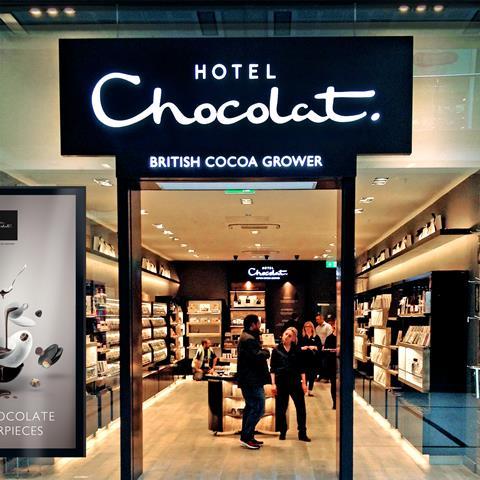

In June, Hotel Chocolat issued its second profit warning in just two months as bosses tried to restart growth at the luxury confectionery retailer, while Virgin Wines UK lowered expectations in January as sales slowed.

“Retailers have enjoyed a relatively positive start to the year, with lower costs also helping companies to meet subdued forecasts,” said Silvia Rindone, EY UK&I retail lead. “But this could just be the eye of the storm.”

Rindone added that energy and food costs were falling, but the release of pressure on disposable incomes was being increasingly offset by increasing rent and mortgage costs.

“Our latest ‘Future Consumer Index’ shows UK consumers’ confidence and ability to spend has all but disappeared in the face of these pressures, with 62% of consumers extremely concerned by the cost of living crisis and two-thirds (67%) expecting it to get worse over the next six months.

“Brands and retailers need to understand the factors influencing their customers and how these make a difference to spending patterns and attitudes. This will help businesses to continuously re-evaluate and simplify ranges and pricing to meet the needs of today’s consumer.”

Nationally, profit warnings issued by UK-listed companies from April to June 2023 marked the highest second quarter total in three years, with 66 warnings issued.

The EY-Parthenon report found warnings from UK-listed companies had risen year-on-year for the seventh consecutive quarter, the longest run of consecutive quarterly increases since 2008. The highest number of Q2 warnings recorded by EY-Parthenon was in 2020, when 166 were issued.

Jo Robinson, EY-Parthenon partner and UK&I turnaround and restructuring strategy leader, said insolvency activity typically peaked about a year after a profit warning peak.

“Conditions are likely to remain challenging and those businesses best placed to persevere will be those that can reshape their operations to withstand further shocks and capitalise on growth,” he added.

No comments yet