The biggest fmcg players were in great shape heading into the coronavirus. And many are ideally positioned to thrive in the ‘new normal’

The coronavirus has whipped up a financial storm, but that hasn’t dampened the spirits of the world’s largest consumer giants. After years of stunted growth and market share being lost to smaller, on-trend rivals, they are fighting back.

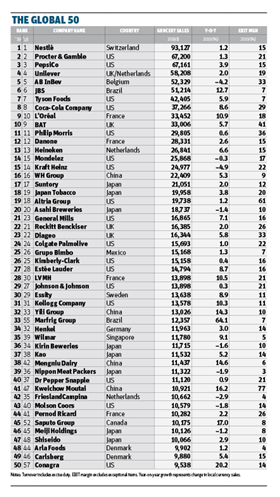

The OC&C/Grocer Global 50 shows the market’s biggest 50 fmcg players entered the coronavirus crisis in better shape than they had been in for many years. Headline revenues grew 3.9% in 2019, up from 3.4% in the previous year. Other than an M&A-driven 5.7% in 2017, that’s the highest growth rate since 2012.

Importantly, this improvement was driven by genuine internal growth. Organic growth was 3.8%, up from 3.2% in the prior year – the highest level seen since the emerging markets boom subsided in the middle of the last decade. “The concerted efforts over the past five years are starting to bear fruit for the big multinationals,” says OC&C UK managing partner Will Hayllar.

He points to their efforts to shift portfolios away from slower-growing categories and to expand, partly by acquisition, into areas with more growth potential. And this could set the Global 50 on a steady path – however stormy the economic climate may get.

OC&C Global 50

Premiumisation was key to last year’s success. While the 1.2% volume growth was slightly ahead of global population growth, the driving force behind the 3.9% uplift in revenue was price mix. Of the 21 Global 50 companies that split out organic sales, it drove growth in every sector bar household and personal care.

This was largely down to more premium cues, rather than like-for-like price increases – particularly given a relatively benign commodity inflation rate. “The better brands have been able to reflect what consumers care about and are therefore willing to pay for, the more they have been able to capture organic growth through premiumisation,” says Hayllar. See Nestlé’s push into premium petcare, for example, or Unilever’s building of a prestige skincare portfolio.

All of which has delivered much-needed top-line improvement. But revenue isn’t the only success story. Operating profit margins among the Global 50 rose 0.2 percentage points to 18.7%, close to the historic 18.9% high seen in 2007. It’s a notable turnaround from the 16.4% in 2016.

“The concerted efforts over the past five years are starting to bear fruit for the big multinationals”

That has been down to another strategic shift. Notably, gross margin eased back 0.1 percentage points from the previous year. So operating margin improvement was driven by cost reductions, which were a product of the frenzy of zero-based budgeting adoption and activist shareholder pressure.

“A number of big fmcg companies were coming towards the end of some very aggressive cost reduction programmes in 2019, which were well on the way to being delivered before Covid hit,” notes Jefferies consumer goods analyst Martin Deboo, pointing to companies such as Unilever, Danone and Nestlé.

Hayllar says the companies that reaped the benefits were the ones who reduced costs wisely. “There have been opportunities to take out costs without fundamentally impacting the aggregate growth rates of the sector,” he says.

The early 2019 profits warning from ZBB poster-child Kraft Heinz proves this isn’t always a successful way to boost profits. “Where you have seen the approach go wrong in certain incidences is where it was pushed too far and started taking out cost that was required to tackle fundamental challenges around the brand proposition,” Hayllar says.

These cautionary tales – see also AB InBev – could now see a shift in focus away from cost-cutting. Liberum analyst Nico von Stackelberg points out some companies “tried to take out the non-working dollars and in doing so cut the fat, but a number also took out a bit of the muscle and in some cases cut into the bone”. For that reason, “investors today hear zero-based budgeting and shudder a little because of the perceived problems that come with it” he believes.

Deboo also finds the woes of Kraft Heinz and AB InBev have “impacted investor confidence in the margin-driven growth strategy”. For him, the Covid crisis has provided something of “a pretext to get away from these aggressive margin targets and back to being focused on growth”.

OC&C Global 50: the five top performing fmcg companies of 2019

Nestlé’s UK & Ireland CEO Stefano Agostini seems to be taking that tack. “Our bottom line is solid and we want to keep that direction, but accelerating the top line is the priority,” he says. “We needed to work on our agility and speed to innovate and we are in a much better position to compete now.”

In fact, the vast majority of the Global 50 are in a good position to compete. Organic sales growth and margin expansion has helped bolster overall balance sheets to potentially insulate them from the short-term hits of coronavirus. OC&C found more than 75% of the Global 50 went into the crisis with debt-to-equity ratios of under two times – generally viewed as the watermark of a healthy leverage.

“Balance sheet strength has helped keep the show on the road during the Covid period,” says Rothschild & Co’s global head of consumer Akeel Sachak. “Grocery staples have had this unexpected tailwind from people being locked down at home and those where the majority of their sales are directed towards take-home grocery sales have seen phenomenal volume growth even in developed markets,” he adds.

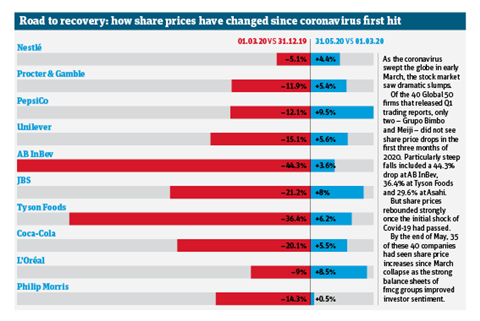

Indeed, among the 40 companies on our list that have reported first-quarter sales figures encompassing the early spread of the coronavirus, there is evidence of the durability of food and drink players. A quarter posted double-digit growth in the period, with the top four growth rates taken by global food suppliers Wilmar, JBS, Marfrig and WH Group.

The companies that struggled during the first quarter were overwhelmingly outside the grocery sector. See cosmetics companies Shiseido and Estée Lauder, or brewers Carlsberg and Molson Coors, which suffered from the closure of bars and restaurants.

There are other factors that have benefited the food and drink players on this list, too. Lockdown played into the hands of larger players “as supermarkets had to prioritise big brands and big SKUs from these big brands and deprioritised insurgent brands, as well as reducing promotions and SKU breadth to ensure they could fulfil essential demand”, says Sachak.

“The smaller, trendy guys tend to have contract manufacturing arrangements and they generally got wrongfooted by the disruption”

The crisis also benefited the long-dated shelf-stable products that the globe’s largest fmcg suppliers tend to sell. “People have been filling up pantries and grabbing brands that they know well rather than looking to experiment,” says Liberum’s von Stackelberg.

These structural tailwinds go some way to explaining why share prices across the consumer goods industry have bounced back since March lows, even for some that suffered out-of-home sales wipeouts.

In essence, the coronavirus seems to have reinstated the competitive advantages enjoyed by multinational giants. “Through the disruption of Covid and ensuing global recessions these big players are going to find themselves well-positioned relative to smaller brands,” Hayllar argues. “The better funding that big multinationals have means that where there is real distress in certain sectors – such as out-of-home consumption – the big players are more likely to withstand it.”

Jefferies’ Deboo also says the ability to supply at large scale has been “a source of competitive advantage” at this time. “The smaller, trendy guys tend to have contract manufacturing arrangements which have been more impacted by the disruption,” he adds.

Even when Global 50 players are particularly exposed to troubled sectors, Hayllar says these businesses tend to have multiple product categories, channels and routes to market to mitigate that disruption. “A degree of diversity, whether that’s your supply chain assets, your category positions or your channel mix, is going to be helpful in terms of reducing volatility,” he says.

Of course, the worst of the volatility looks to be coming to an end. Lockdown is easing or over in most markets and shopping habits are returning somewhat towards pre-Covid norms. Even as normality returns, though, the major food and drink players will continue to see beneficial effects because the pandemic has ushered in long-lasting changes to the grocery channel mix.

The Global 50’s biggest M&A deals

- Asahi bought Australia’s biggest brewer Carlton and United Breweries from AB InBev for $11.3bn to continue to grow its global footprint.

- PepsiCo acquired South Africa-based food, beverage and snacks producer Pioneer Foods for $1.9bn to broaden its penetration into Africa.

- Colgate Palmolive bought out French provider of anti-ageing medical products Laboratoires Filorga Cosmetiques for $1.7bn.

- Saputo took UK dairy player and Cathedral City maker Dairy Crest private in a $1.6bn deal to boost its UK presence.

- Kirin Breweries bought a 32.9% stake in Japan-based cosmetics and nutritional supplements supplier Fancl Corporation in a deal worth $1.2bn.

Long-term change

The shift to in-home calorie consumption and ongoing prevalence of home working will take a long time to unwind. Safety concerns and a likely economic downturn seem set to continue feeding increased appetite for home cooking, while health and hygiene are working hand in hand for once in personal care.

Some Global 50 companies are exposed significantly to food-to-go, but the breadth of their businesses should help insulate them from these downturns while being boosted from a long-term shift to at-home consumption.

Second, the global growth of online grocery during Covid-19 – OC&C suggests it underwent a four-year change in terms of penetration in just four weeks – is unlikely to reset to a great extent. E-commerce growth moved from 13% in the UK pre-Covid to 30%, from 56% to 73% in the US and 40% to 110% in Spain.

A permanent shift to online grocery is likely to benefit the larger players, says Deboo. “Online theoretically lowers the barrier to entry for smaller players, but all the evidence suggests that consumer appetite to search for everyday products online is very limited,” he points out. “So even in the case of Ocado – arguably the world’s most sophisticated grocery retailer – they still need to keep their robotic warehouses busy with fast-moving lines that are bought in large volumes.”

“For almost the first time, large consumer goods companies are thinking much more aggressively about DTC”

Hayllar tells a similar story. “As people shop by favourites online, it can actually play into the hands of the big players as those are the brands more frequently searched for and it is harder for smaller brands to disrupt with promotions,” he explains.

Plus, let’s not forget the pandemic has also prompted large brand owners to bypass the retailers altogether. Major players like PepsiCo and Heinz have launched direct-to-consumer websites during the lockdown to broaden their digital capabilities, enabled by new platforms from the likes of Shopify and The Hut Group.

“For almost the first time, large consumer goods companies are thinking much more aggressively about DTC,” says Sachak. “That trend isn’t going to reverse and will have more investment behind it than ever.”

So all in all, things are looking pretty positive for the Global 50, even as a pandemic rages on and worldwide recession looms. That doesn’t mean they can rest on their laurels, though. The Global 50 will need to continue to tailor their portfolios and product offerings to reflect fundamental long-term consumer trends, and avoid areas that will be derailed by the pandemic.

For an example of the latter, see travel retail. A slump in revenues – estimated to drop by up to 60% in the next 12 months – will continue to have a damaging effect on those operating in this space, such as cosmetics firm Shiseido and spirits player Pernod Ricard.

It is also worthy of note that both of these names play in the luxury end of the market. Because the shift to premiumisation that characterised last year may also come under threat. Liberum’s von Stackelberg suggests a recessionary period could delay the price mix improvements made by the big fmcg players.

However, he stresses that this will only be temporary. “Make no mistake, over a 10-year period this trend will continue… Over a longer term global GDP should continue to outpace population growth, meaning in theory people will become more wealthy and be able to spend a little more to trade up,” he says.

Premiumisation and health

Hayllar remains fairly confident in the future of premiumisation. “Inevitably people are going to have less to spend and will have to justify their trading up decisions more actively,” he says. “But the direction of travel will not reverse – those brands able to give people a measure of aspiration but in an affordable way will win out.”

Similarly, the growing importance of health, wellness and provenance are also only likely to receive a temporary setback from any recession. While consumers may feel less enthused about paying a premium for healthy produce, the coronavirus has also heightened issues around food quality and fresh ingredients.

During the pandemic, consumers have reported eating fewer unhealthy snacks and processed foods, while cooking at home has led to increased consumption of fresh foods and ingredients.

“Health and wellness are absolutely here to stay,” says Sachak. “The pandemic has made a significant issue of traceability and hygiene and that is probably going to mean packaged goods could benefit against artisanal, locally produced goods that cannot operate the same hygiene protocols.”

These areas have been a focus of Global 50 M&A activity in recent years – and 2019 was no exception. Overall, last year’s activity was modest, with deal numbers down 13% to 48 and deal values down by 40% to €45bn as only Asahi’s purchase of AB InBev’s Australian operations topped $10bn.

“Health and wellness are absolutely here to stay”

However, demand for higher-growth natural and healthy assets continued. Unilever’s buyout of Graze and PepsiCo’s deal for Natural Foods were joined by deals for Filorga, Fanci and Drunk Elephant in beauty and cosmetics. It marked a continuation of 2018, when three of the top 10 deals were in consumer health.

Understandably, the coronavirus has put a temporary block on this type of targeted M&A. Deal activity has remained relatively scarce in the first six months of 2020 amid ongoing disruption and uncertainty.

However, in the longer term, observers suggest the market turbulence and economic downturns caused by the coronavirus should act as a strong incentive for larger players to partake in M&A.

“The cost of debt is epically low so those with stronger balance sheets should be able to buy assets cheaply and there will be distressed assets on the market,” says Deboo, though he cautions that many distressed assets will be focused on the foodservice sector, which isn’t particularly attractive to buyers at this time.

“We are active in M&A opportunities in segments that will give us a stronger portfolio and more opportunities to boost growth,” says Nestlé’s Agostini. “But we are not looking to take advantage of the crisis. We don’t look for companies that are in difficulty, we are looking for companies that can give us opportunities for productive partnerships and growth.”

Sachak foresees a prevalence of all-stock mergers that do not stress balance sheets, in addition to well capitalised players absorbing businesses from other multinationals who have gone into the coronavirus crisis over-leveraged and need to offload assets.

“The reasons for consolidation are perhaps more relevant in a post-lockdown world as topline growth may be more challenging, so consolidations to take out costs is an obvious alternative,” he says.

After all, growth-focused M&A was one of the Global 50’s key responses in 2017 to a crisis of organic growth. So it is likely to pull this lever again if global consumer spending is under pressure.

Still, it’s important to note that we are in a very different environment from 2017. The fundamental learning from the past year is this: the Global 50 has finally got to grips with the core issue of investing and innovating to drive increased sales.

Although the coronavirus crisis may have disrupted many things this year, it should not be a cause to rip up the long-term advancements the Global 50 is making in terms of finding and investing in pockets of growth and giving consumers what they want. “Structurally the big players were always best positioned to win,” observes Sachak. “For a while they weren’t winning, but that was because they took their eye off the ball and stopped believing they could win with what they had.”

Global fmcg businesses are well placed to ride out this economic storm, and some semblance of normality will eventually return. When it does, these giants must continue to modernise their offer – or all their structural advantages will eventually count for nought.

The Global 50 is based on analysis by OC&C into the world’s 50 largest fmcg suppliers. OC&C is a consultancy offering strategic advice to top management on the most complex issues in fmcg. To find out more about the Global 50 contact OC&C on 020 7010 8000 or visit www.occstrategy.com

No comments yet