As supermarkets struggle, the search for growth is all-consuming. Over the next 10 pages, The Grocer’s Fast 50 showcases the UK’s fastest growing privately owned suppliers. The ranking features some familiar names and some exciting newcomers. So how are they achieving growth where others are failing? What are the sectors they are operating in? What are the secret ingredients of their success?

01 (NEW) BrewDog

Formed: 2007

Sales: £18m

2yr CAGR: 74.8%

Owned by: Co-founders Alan Martin Dickie and James Watt, plus eight other main shareholders and over 15,000 crowd-funded shareholders.

What’s happened: Just seven years old, this upstart craft beer brewer has won countless awards. But its genius has been combining craft with crafty marketing.

A self-styled iconoclastic brand, it’s gained tons of cheap publicity with oddball beer names (Tactical Nuclear Penguin, anyone?) and even odder stunts (such as maturing beer on the deck of a working fishing trawler).

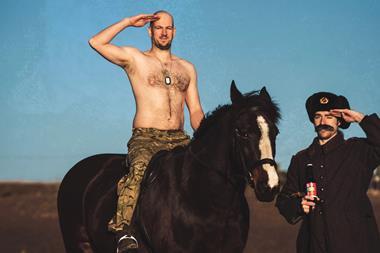

Arguably its most daring stunt came earlier this year, mocking Vladimir Putin’s notoriously homophobic utterances in the run-up to the Winter Olympics in Sochi with the launch of a double IPA 8.2 abv beer called ‘Hello, my name is Vladimir’.

“I am a beer for uber hetero men who ride horses while topless and carrying knives,” read the blurb. “I am a beer to mark the 2014 Winter Olympics. But I am not for gays. Love wrestling burly men on the Judo mat or fishing in your Speedos? Then this is the beer for you!”

BrewDog sent a case to the Kremlin and also donated 50% of the profits from the beer to “charitable organisations that support like-minded individuals wishing to express themselves freely without prejudice.”

BrewDog has regularly found itself in hot water with the Portman Group, refusing to kowtow to concerns about super-strength beers by brewing the world’s strongest beer (Tokyo), and a beer spirit (WattDickie) - and garnered headlines earlier this year for an expletive-laden attack on the drinks industry’s self-regulation body following repeated criticism of its marketing and conduct.

Stocked nationally in Tesco, it has also funded rapid growth of both its beer sales and BrewDog bars (18 so far across the UK and five overseas) by becoming a ‘public’ company that is not listed, having made shares available via its ‘Equity for Punks’ crowdfunding scheme in three releases from 2009 to 2013.

So far, the crowdfunding scheme has raised more than £6.5m, but co-founder James Watt has promised a £1bn IPO in 2019, according to a report in The Times. It also revealed plans to launch a spirits division this year.

Figures-wise, pre-tax profits exploded by 385% to £2.3m on sales of £18m (up 69%) in 2013. Expected sales of £32m for FY2014, would put its CAGR at 57.7% next year.

02 (03) JDM Food Group

Formed: 2007

Sales: £24.6m

2yr CAGR: 66.2%

Owned by: Tim Bertin

What’s happened: The Lincolnshire-based food processor and distributor climbed one place to second in this year’s ranking. JDM has invested £4m in boosting its production plant as it expands in the UK and beyond. Initially focused on producing garlic, it now sources, pre-packs and prepares a wide range of fresh produce - including ginger, sweet potatoes, butternut squash, onions, chillies, sun-dried tomatoes and beetroot (below) - from around the world. It also makes sauces, dips, marinades, rubs and purées.

Its clientele spans small independent retailers through to global supermarket chains, as well as food manufacturers and foodservice companies. It also recently signed a production deal with US giant Sugar Foods.

Sales grew 47% to £24.6m in 2012, while pre-tax profits soared 352% to £571,000.

Run by founder Tim Bertin and MD Jon Chesworth, it was named as one of the UK’s 1,000 most inspiring companies by the London Stock Exchange, one of only 14 food production companies within the report.

03 (NEW) Cawingredients

Formed: 2008

Sales: £44.3m

2yr CAGR: 65.2%

Owned by: The Cawthray family and Richard Harrison

What’s happened: Cawingredients is a relative newcomer, opening its £20m factory near Bedale in 2010. It recently created 100 jobs as part of an expansion programme at the site that will double its workforce there in 2015.

04 (01) Boparan Holdings

Formed: 1993

Sales: £2,884m

2yr CAGR: 44.8%

Owned by: Ranjit Singh Boparan

What’s happened: While Boparan Holdings continues to grow (6.1%) thanks in part to NPD, growth has slowed as the business has suffered some indigestion following recent acquisitions, including its £342m purchase of Northern Foods in 2011.

05 (NA) Specialty Powders

Formed: 2010

Sales: £43.6m

2yr CAGR: 42.4%

Owned by: Mike Kirby

What’s happened: SPH’s appearance on the list is driven by its deal to buy Corby-based Phoenix Foods in 2012 and a joint venture with Premier Foods. The JV, called Knighton Foods, will produce Premier’s powdered goods including Bird’s and Angel Delight.

06 (NEW) Hotel Chocolat Group

Formed: 1993

Sales: £67.8m

2yr CAGR: 40.4%

Owned by: Angus Thirlwell and Peter Harris

What’s happened: Making its first appearance on the Fast 50, the group continues to expand its retail outlets in the UK with railway station shops, a café, restaurant and School of Chocolate. It now has 75 outlets in the UK. It is also expanding beyond the UK, opening shops in Copenhagen and Amsterdam as well as broadening its beauty range with bath and body products. This year it also launched a “game-changing” lower-sugar milk chocolate bar. Group sales rose 6% to £67.8m in 2013. Its subsidiary Hotel Chocolat Ltd posted sales of £13.5m, up modestly from £13.1m the year before. Pre-tax profits fell 30% to £2.06m. In 2012, the group hired PricewaterhouseCoopers to explore a sale and was in talks with potential buyers, with a price tag rumoured to be between £50m and £100m.

07 (NEW) Pukka Herbs

Formed: 2001

Sales: £13.0m

2yr CAGR: 39.5%

Owned by: Sebastian Pole and Tim Westwell

What’s happened: The herbal teas, food and remedies company is experiencing phenomenal growth, doubling turnover every two years. Now the second-biggest herbal tea brand in the UK, it exports to more than 30 countries.

08 (NEW)Fever-Tree

Formed: 2005

Sales: £23.3m

2yr CAGR: 39.1%

Owned by: LDC, Charles Rolls and Tim Warrillow

What’s happened: Grew international sales 50% in 2013. This year it entered its 50th export market with £48m of backing from Lloyds banking group. Will seek to raise £4m with an AIM flotation expected to value it at £200m.

09 (NEW)Dearne Valley Foods

Formed: 1990

Sales: £11.7m

2yr CAGR: 37.2%

Owned by: Michael Shanahan

What’s happened: Bouncing back after a disastrous factory fire in 2010, Rotherham-based savoury snacks business Dearne Valley Foods, which makes savoury snacks for retailers and wholesalers, is firmly on the comeback trail.

10 (NEW) Meantime Brewing Co

Formed: 1999

Sales: £11.5m

2yr CAGR: 37%

Owned by: Several shareholders, including the directors

What’s happened: Sales up 30% to £11.5m while profits tripled to £572,000 to the end of 2013. Listed in the major multiples, exports to 30 countries and is targeting 40 more in South-East Asia, Scandinavia and the Americas.

11 (15)Tyrrells

Formed: 2002

Sales: £41.3m

2yr CAGR: 36.5%

Owned by: Investcorp

What’s happened: Bold branding, strong export sales, successful diversification in to popcorn, and new ownership, by Dubai-based Investcorp, which bought the company in 2013 for £100m, has boosted the fortunes of the luxury crisp brand.

Kober 12 (NEW)

Forme d: 2010

Sales: £139.6m

2yr CAGR: 34.3%

Owned by: Forza

What’s happened: Asda is said to have taken control of Kober, which produces 500 tonnes of bacon every week, to take more control of its supply chain and to pursue economies of scale. Pre-tax profits were static at £1.9m in the year to 31 December 2013 despite an increase in sales of 5% to £139m.

13 (NEW) Pakeeza Dairies

Formed: 1984

Sales: £14.8m

2yr CAGR: 33.8%

Owned by: Family-owned and run

What’s happened: The Rochdale-based maker of yoghurts, lassi and margarine has won four international industry awards for quality produce and has debuted on the Fast 50 list thanks to deals to supply Asda, Sainsbury’s, Tesco and Morrisons.

14 (NEW) Bath Ales

Formed: 1995

Sales: £9.7m

2yr CAGR: 33.8%

Owned by: Co-founders

What’s happened: Bath Ales sells beers nationally through Sainsbury’s, Waitrose and Ocado, and regionally through Tesco and Morrisons. It exports to nine countries including Mexico, Russia and Brazil and runs a dozen pubs in the Bristol area.

15 (19) Harder Bros

Formed: 1939

Sales: £35m

2yr CAGR: 32.4%

Owned by: The Harder family

What’s happened: Leeds-based Harder claims to be the largest processor of sheep sausage casings in the UK. It also supplies pork and beef casings as well as co-packing lamb, pork and beef products for supermarkets and independent butchers in separate facilities.

16 (NA) LJ Fairburn & Son

Formed: 1951

Sales: £30.7m

2yr CAGR: 30.8%

Owned by: The Fairburn family

What’s happened: Stopped working through Noble Foods Group to market its products independently and now trades with Asda, the Lincolnshire Co-op, Iceland, Sainsbury’s and Aldi. It has boosted its rapid growth thanks to £14m of funding from Barclays Bank.

17 (NEW) GRH Food Company

Formed: 1989 (incorporated 2002)

Sales: £16.8

2yr CAGR: 30.5%

Owned by: Gareth & Andrew Hockridge

What’s happened: Strong sales and profit growth bring a Fast 50 debut for the GRH Food Company.

Based in Pwllheli, North Wales, this cheese producer, processor and packager supplies its predominantly hard cheese in the form of ‘Signature’ graded, block, sliced and blended cheeses to retail, industrial, wholesale and food service customers. It also offers packs of grated mozarella ‘pizza cheese’ under the Papa Gino label, which it supplies to high street discounter 99p stores.

GRH employs 44 people and says it has a state-of-the-art production plant, including a fully automated grating line.

Pre-tax profits more than doubled from £313,000 to £661,000 in the year to 31 March 2013, while sales increased from £11.1m to £16.8m, pushing it to number 17 in the list. It also offers advice to the pizza and foodservice industries.

18 (25) Benriach Distillery Co

Formed: 1898

Sales: £34.2m

2yr CAGR: 30.2%

Owned by: Geoff Bell, Wayne Keiswetter and Billy Walker

What’s happened: Acquisitions and record sales have seen the distiller rise from 25th to 18th place. In August, the company announced record annual pre-tax profits of £8.9m on a turnover of £34.5m.

19 (14) Lynn’s Country Foods

Formed: 1985

Sales: £20.2m

2yr CAGR: 29.7%

Owned by: Denis Lynn

What’s happened: Founder and MD Denis Lynn has overseen annual growth of at least 40% every year since 2001 at the County Down venison and pork sausage producer. He plans to hit sales of £380m and double sales outside Northern Ireland this year.

20 (NEW) Benson Park

Formed: 2002

Sales: £24.6m

2yr CAGR: 29.5%

Owned by: Cranswick

What’s happened: Benson Park supplies poultry ingredients for the sandwich, salad and chilled sector, employing 90 staff at its Hull factory. It hit sales of £41.1m for the 12 months to 31 August. Cranswick has just acquired Benson Park in an undisclosed deal.

21 (12) Thatchers Holdings

Formed: 1904

Sales: £51.9m

2yr CAGR: 29.1%

Owned by: The Thatcher family

What’s happened: Thatchers, which has won listings in Tesco, Sainsbury’s, One Stop and Shell forecourts for its premium Gold, Vintage and Katy lines, recently partnered with the US arm of brewer Innis & Gunn to launch Thatchers Gold in the American market.

22 (NEW) Norfolk Free Range

Formed: 2003

Sales: £13.5m

2yr CAGR: 28%

Owned by: The Hart family

What’s happened: Based in Wisbech, Cambridgeshire, Norfolk Free Range makes its debut on the Fast 50 after celebrating a decade in business by hitting sales of £13.5m. The privately owned company specialises in raising and processing free-range pork.

23 (49) Staveley’s Eggs

Formed: 1970

Sales: £18.5m

2yr CAGR: 27.9%

Owned by: The Staveley family

What’s happened: Rapid growth has seen Staveley’s jump up from 49th to 23rd. The Coppull, Lancashire-based producer and packer of free-range and colony-intensive eggs supplies the multiples, including Asda, with its free-range eggs.

24 (06) Aspall Cyder

Formed: Incorporated 1986

Sales: £19.8m

2yr CAGR: 27.7%

Owned by: The Chevallier Guild and Guild families

What’s happened: Chairman Barry Chevallier Guild says exports are thriving this year, with “fantastic growth” to the US, China and India. Pre-tax profits grew strongly from £346,000 to £523,000 in the year to 31 March 2013 on sales of £19.8m.

25 (09) Nigel Fredericks

Formed: 1890

Sales: £36.4m

2yr CAGR: 27.1%

Owned by: The Fredericks family

What’s happened: though compound annual growth has slowed (from 37%), this North West London-based premium catering supplier is still growing, selling vintage dry aged Scotch beef, poultry, game, plus bases, marinades, sauces and hand-made canapes.

26 (28) Chris Eley Produce

Formed: 1985

Sales: £17.6m

2yr CAGR: 26.8%

Owned by: Chris Eley

What’s happened: The website of this Spalding-based vegetable grower and packer is even more basic than its caulis and broccoli but, growing produce on 750 acres of land in Lincolnshire, it nudged up the Fast 50 by two places this year.

27 (30) The BIG Prawn Co

Formed: Incorporated 1998

Sales: £18.9m

2yr CAGR: 26.7%

Owned by: Sean Dennis O’Hanlon

What’s happened: This year launched new lines with Ocado and Waitrose. Sales grew to £18.8m in the year to 31 May 2013 from £14.8m the year before. Pre-tax profits almost doubled, up from £344,000 to £601,000.

28 (NEW) Broadland Wineries

Formed: 1965

Sales: £42.3m

2yr CAGR: 26.5%

Owned by: Jonathan Mark Lansley

What’s happened: After going into administration in 2006, a new management team revamped the business and began selling direct to retailers from 2010. This year it signed a three-year deal to supply own-label, single-serve wine.

29 (13) Bread Holdings

Formed: Established 1992. Incorporated 2011

Sales: £27.7m

2yr CAGR: 26.1%

Owned by: Bread Acquisitions

What’s happened: The group includes the Bread Factory and Gail’s. In 2011, Risk Capital backed the MBO. Group sales grew from £20.4m to £27.7m in the year to 28 February 2013. Pre-tax profits rose from £555,000 to £882,000.

30 (05) Westbridge Food Group

Formed: 2007

Sales: £264.6m

2yr CAGR: 26.1%

Owned by: Peter McNeil

What’s happened: Growth has slowed at the poultry specialist in its most recent results, following a period of acquisitions, the creation of new sales channels and advantages it enjoyed in the aftermath of Horsegate, when shoppers opted for more poultry products.

31 (NEW) Belvoir Fruit Farms

Formed: 1984

Sales: £14.2m

2yr CAGR: 25.5%

Owned by: Peverel Manners

What’s happened: Strong volume growth in premium cordials has helped Belvoir power into the Top 50 this year. A new range of lower sugar cordials, new premium pressé recipes and a debut in cans look set to continue to drive sales growth.

32 (NEW) Safe House Holdings

Formed: 2002

Sales: £39.4m

2yr CAGR: 25.3%

Owned by: Mark Woodington & Pete Hobbs

What’s happened: Safe House operates as BM Foods. The Avonmouth-based meat processor and wholesaler occupies a 35,000 sq ft food factory and will shortly expand into an adjacent site.

33 (NEW) Pinnacle Foods

Formed: 2007

Sales: £17.2m

2yr CAGR: 24.6%

Owned by: Graham Reed & Chris Wilson

What’s happened: This foodservice and retail meat and poultry supplier was formed after the merger of Wilsons Frosted Meats and Pinnacle Meats. It has expanded following a move into new production facilities in Hampshire.

34 (16) Cornish Farm Dairy

Formed: 1994

Sales: £25.9

2yr CAGR: 24.6%

Owned by: Bill Clarke

What’s happened: Strategic growth, new product development and strong branding has helped the Lostwithiel-based dairy continue its rapid growth. Its Trewithen Dairy Spreadable won the Butters & Spreads category at The Grocer’s New Product Awards this year.

35 (NEW) PK Food Concepts (Pasta King)

Formed: 2009

Sales: £16.5m

2yr CAGR: 24.3%

Owned by: NBGI Private Equity Fund, Howard Farquhar and others

What’s happened: The PK group was formed in 2009 following an MBO of Pasta King (UK), which has provided meals and snacks to the educational and foodservice sectors since 1994. in 2011, PK purchased and rebranded sandwich maker Tasties of Chester.

Pasta King and Tasties now form the backbone of the group, offering hot and cold meals and snacks from two BRC grade A facilities in the North and South of England. The group supplies nationally through distributors and its fleet of branded vans.

Recent NPD includes its Street Heats, which can be prepared centrally and moved to satellite units where they can be held hot, as well as microwaveable, vending-machine-compatible snack pots.

36 (52) Laila’s Fine Foods

Formed: 1986

Sales: £14.6m

2yr CAGR: 24.2%

Owned by: The Remtulla family

What’s happened: This family-run Blackpool business specialises in ready meals for both the foodservice and retail markets. It has grown by more than 25% since 2011 and recently secured a multimillion-pound deal with Iceland to supply Mexican ready meals.

37 (NEW) Greencroft Bottling Co

Formed: 2003

Sales: £22.3m

2yr CAGR: 24%

Owned by: Lanchester Group

What’s happened: One of the largest wine bottlers in the UK, running a 70,000 sq ft bottling facility and a 240,000 sq ft warehouse. It also has an innovative high-speed Tetra Pak filling line. It is planning to open a new £2.2m warehouse to cope with expansion.

38 (35) UK Snacks

Formed: 1977

Sales: £15.1m

2yr CAGR: 23.7%

Owned by: Ghulam Nazir, Shabaz Ahmed

What’s happened: Family owned manufacturer and wholesaler of sweets and savoury snacks based in East London, UK Snacks specialises in supplying bagged snacking products to Tesco, Asda, Sainsbury’s and Morrisons.

39 (21) Dogsthorpe Acquisitions

Formed: 1886

Sales: £196m

2yr CAGR: 23.6%

Owned by: Michael George

What’s happened: High wheat prices and growing volumes have helped this family-owned miller keep its place in the Fast 50 in recent years. In 2012, the Wellingborough-based business paid £450,000 for the business and assets of Smiths Flour Mills.

40 (NEW) Ragleth

Formed: 2005

Sales: £109.1m

2yr CAGR: 22.5%

Owned by: Ragleth private investors

What’s happened: The Norfolk company sells 250,000 tonnes of malted cereals a year to brewers and distillers. Sister business Edme Food Ingredients supplies the baking, cereal and food industries. Customers include Fine Lady Bakeries, Carlsberg and Stella Artois.

41 (NEW) Haywood & Padgett

Formed: 1987

Sales: £20.1m

2yr CAGR: 21.7%

Owned by: Wayne Padgett

What’s happened: Yorkshire-based Haywood & Padgett started life in 1987 as a two-man operation running out of a small rented unit. It is now the UK’s largest scone manufacturer, producing about 4.5 million scones a week and employing more than 100 people.

Its 31,000 sq ft, purpose-built factory can produce over 50,000 scones per hour. It bakes branded and non-branded products for the supermarkets, including Tesco, Asda, Sainsbury’s, Morrisons and Iceland, and the foodservice sector, as well as brands like Tetley, which launched a range of scones in 2011 in three different flavours.

It sells in Europe and as far afield as Australia and Japan. Solely owned by the Padgett family, it is run by MD Wayne Padgett, one of the two original founders of the scone operation. His daughter Rebecca has since joined him.

42 (21) John Sheppard Butchers

Formed: 1965

Sales: £12.1m

2yr CAGR: 21.4%

Owned by: The Sheppard family

What’s happened: The Bristol-based butchers supplies meat to customers including hotels and restaurants, hospitals, schools, universities and large food manufacturers. Its national home delivery service, John Sheppard Direct, is helping drive growth.

43 (NEW) Kolak Snack Foods

Formed: 1985

Sales: £77.5m

2yr CAGR: 21.3%

Owned by: The Lakhani family

What’s happened: Last year the snack food business acquired the business assets and customer base of Berkshire Foods and NC Snacks. It also opened a £9.6m, 45,000 sq ft facility dedicated to extruded snack products and ready-to-eat popcorn.

44 (33) R Thompson & Son

Formed: 1967

Sales: £16.5m

2yr CAGR: 20.7%

Owned by: The Thompson family

What’s happened: The Armagh-based family business packs two million eggs each week for British wholesalers, supermarkets and other customers throughout Ireland. The company also operates a plant producing pasteurised egg.

45 (32) Skea Egg Farms

Formed: 1970s

Sales: £16.5m

2yr CAGR: 20.7%

Owned by: Matthew Hayes

What’s happened: MD Matthew Hayes started this Northern Ireland business in the early 1970s, initially serving the wholesale market supplied by family run farms. It now serves the major grocers as well packing eggs produced by 1.2 million birds.

46 (NEW) Faccenda Investments

Formed:

Sales: £536.2m

2yr CAGR: 20.6%

Owned by: Hillesden Investments

What’s happened: The poultry supplier has seen profits leap 46% to £5m in the year to 27 April 2013, on sales up 3.9% to £365.2m, after increasing volume sales, adding value to existing products and benefiting from lower interest payments.

47 (NEW) Cobell International (Primeturn)

Formed: 1999

Sales: £37.3m

2yr CAGR: 20.4%

Owned by: Nick Sprague and the directors

What’s happened: Cobell imports, blends, stocks, packs and distributes a huge range of processed fruit juice concentrates, NFC fruit juices and fruit purées, as well as ice cream, condiments and ready meals. It forecasts sales of £45m this year.

Cobell also owns Frobishers, a premium bottled fruit juice brand it acquired in 2009. It sold the PWR+ brand to G’s Fresh in June 2013.

Cobell operates one of the few aseptic packaging facilities in the UK, which allows products that would normally require frozen storage to be held at ambient or chilled temperatures, making it easier to store, handle and transport. It also extends shelf life compared with normal packaging.

48 (NEW) Rare Group

Formed: 2000

Sales: £18.8m

2yr CAGR: 20.4%

Owned by: David House and Justin Preston

What’s happened: Set up to supply “discerning” catering customers with high-quality meats, the Rare Group says it can hang up to 800 loins and 600 ribs at a time in specially designed chillers for up to 35 days.

49 (NEW) Cook Trading

Formed: 1997

Sales: £31.9m

2yr CAGR: 20.3%

Owned by: Edward Perry and Dale Penfold

What’s happened: The frozen ready meals specialist from Kent enjoyed 12% sales growth last year, has 70 shops, 500 employees, expanding online delivery and branded freezer operations selling into over 400 independent retailers.

50 (48) Paynes Dairies

Formed: 1995

Sales: £87.1m

2yr CAGR: 20.2%

Owned by: Charles Payne

What’s happened: Paynes supplies raw and processed milk and cream to wholesalers and manufacturers. MD Charles Payne established a dairy farm in 1972 but began collecting from other farmers following deregulation of the Milk Marketing Board.

No comments yet