The UK has always punched above its weight when it comes to food tech. It’s where Lord Rank discovered the fungi microorganism fusarium that would be fermented into Quorn’s pioneering mycoprotein. It was researchers at the University of London’s Queen Elizabeth College that discovered sucralose – now one of the world’s most widely used artificial sweeteners. And it’s also where the first $300,000 cultivated meat burger was devoured live on TV in 2013.

There are now nearly 800 agrifood tech companies operating in the UK, according to Forward Fooding’s FoodTech Data Navigator – second only to the US – working on everything from next-gen alcohol alternatives to fibre-based sugars with half the calories.

“The UK is one of the most vibrant hubs for the sector alongside Silicon Valley, Tel Aviv, New York and Singapore,” says its co-founder Max Leveau.

But what has put the UK in such a good position? And will it last?

Unlike other European countries, the UK doesn’t have a specialism when it comes to food tech, according to Matthieu Vincent, partner at DigitalFoodLab. Whereas Germany is known for startups focused on the last mile, France for its agtech and the Nordics for sustainable innovation, the UK “is deeper and more well distributed” with “a large number of good startups in each of the different food tech categories. So, no matter what the new hot agriculture food trends are, the UK has startups raising quite significant amounts of money,”, Vincent says. And in addition, “the UK has historically more investors with deeper pockets”.

Last year, UK-based companies attracted 10.5% of all global agrifood tech investments (£1.36bn), according to Forward Fooding, and 30% of all AgriFoodTech investment across Europe. That included £1.5m raised by meat alternatives startup Adamo Foods from SFC Capital, – the third VC to back the business –and £24m by Cambridge-based cultivated pork developer Uncommon, led by VC Balderton Capital.

Already, 2024 is following in a similar vein. In March, Clean Food Group, which makes sustainable oils and fats using fermentation, raised an additional £2.5m from climate-specific VC Clean Growth Fund – taking its total to £13m raised to date. “We’ve had the opportunity to partner with visionary venture capital funds here in the UK, which empower early stage entrepreneurs with expert capital to tackle the climate crisis,” says CEO Alex Neves.

Investment isn’t always from VCs, either, with many UK food tech startups and scaleups opting to reach out to angel investors or via crowdfunding, according to Amy Pierechod, partner and head of startups and emerging companies at law firm Gordons. “They can see and taste products, and in doing so, have another means to understand any potential risks to their capital,” she says. Nootropic non-alcoholic beer company Impossibrew took this approach and raised more than £750k via crowdfunding last year – achieving its £400k target within 10 minutes of launch.

“The UK government has made substantial investments, earmarking funds to drive innovation forward”

Strong government support for food tech and world-class academic institutions are another factor behind a thriving startup ecosystem here in the UK, says Leveau. “The UK government has made substantial investments in universities, companies, and research centres, earmarking funds to drive innovation forward. For instance, investing £12m in fermentation research at Imperial College London in 2024. Research institutions such as Imperial College, meanwhile, “attract tech talent from around the world [to] cultivate a diverse and innovative workforce”.

“Overall, the UK cultivates an environment conducive to entrepreneurship through strategic partnerships and robust infrastructure, facilitating the translation of cutting-edge research into tangible solutions that drive economic growth and societal impact..”

Added to this is a consumer base willing to experiment with novel foods. By 2022, for example, the UK became the second-largest consumer cannabinoid market in the world, behind the US, as a result of soaring consumer interest in CBD-infused oils, drinks and snacks. And In one 2021 study published in the scientific journal Foods via MDPI, 88% of Gen Z consumers and 85% of millennials said they were open to trying out cultivated meat products.

Read more:

-

Do Getir’s woes show quick commerce just can’t work?

-

Gousto’s Shaun Pearce on taking recipe boxes mainstream

-

How artifical intelligence can transform food distribution

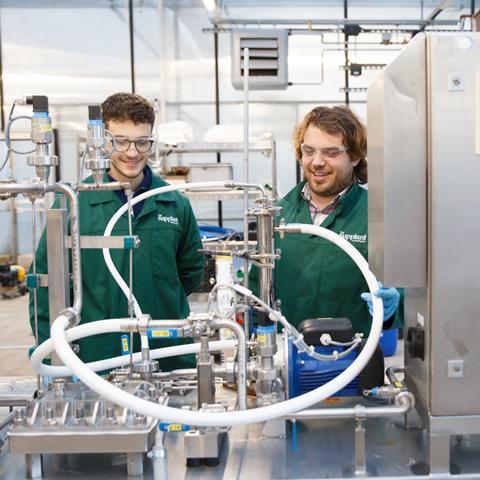

“From a customer perspective, although we launched in the US several years before entering the UK market, we’ve been delighted by how quickly our products have gained traction on home soil,” says Tom Simmons, CEO of The Supplant Company, which creates sustainable replacements for refined sugar and starch.

But while entrepreneurialism, active investors and experimental consumers are all helping to feed into the growth of food tech in the UK, there are clouds on the horizon – particularly when it comes to transferring food tech concepts from the lab to commercial availability. “It currently takes too long for these companies to gain regulatory approval for their products in the UK compared to elsewhere,” says Hermione Dace, a policy advisor specialising in food and agriculture at the Tony Blair Institute.

“The FSA doesn’t have the resources and lacks specialist skills to process applications. Companies are already looking to markets such as Singapore, where policy encourages regulators to be forward-thinking – providing guidance on preparing applications, with open dialogue on draft submissions.”

Brexit has amplified this, with well-documented delays around novel food applications for CBD and edible insects. Regulators need better funding and “the right expertise”, adds Dace.

“The aftermath of Brexit has [also] posed challenges such as limiting access to talent,” says Leveau. “This situation has prompted startups in the EU to seize the opportunity to develop an edge, as they can serve a broader market.”

There are reasons to be hopeful, though. The UK’s FSA recently agreed to update regulations for precision fermentation-derived ingredients and cell-based meat following a board meeting on 20 March, says Leveau.

And “even though the regulatory process in the UK is still being refined, regulators have shown great willingness to engage with companies, and policies such as R&D tax credits incentivise investment in innovation”, says Ed Steele, co-founder at cultivated fat startup Hoxton Farms.

It’s why, for now at least, the UK remains home to a raft of startups and scale-ups operating at the leading edge of global food tech

Here are eight of them:

The Supplant Company

Finding replacements for sugar and flour via agricultural waste

Although it’s been operating for less than a decade, The Supplant Company already has two of its products in the US and UK markets – the first its flagship sugar replacement and the second a flour replacement.

Both are made by “upcycling agricultural side-streams” such as corn cobs, oat hulls and wheat stalks, explains CEO Tom Simmons. To create its ‘sugar from fibre’ the team then add enzymes, sourced from fungi, to these by-products, which break down the long chains of sugar found in their fibres. Their flour replacement, meanwhile, is made using the whole wheat crop, rather than simply the grain, which makes it lower calorie and higher in fibre.

“Our technology can be applied to side-streams from almost any agricultural crop,” says Simmons.

By 2050, it’s estimated that the world will need 50% more food and so by “upcycling the leftover parts of crops that are typically wasted, we can improve the accessibility and efficiency of the food system without planting a single extra crop”.

Already working with “several of the world’s largest fmcg companies, who are preparing to integrate our ingredients into their product/brand portfolios”, the team has recently made significant strides forward in its production capacity.

Adamo Foods

Using mycelia to mimic red meat

The “ultra-realistic” steak alternative by startup Adamo Foods is already attracting plenty of investor interest.

Last year Adamo, which launched in 2021, secured £1.5m in funding from UK seed-stage investor SFC Capital, and won innovation grants of more than £1m.

Its patent-pending tech relies on mycelia, the root-like structure from which fungi grow, to form the base of its meat alternative. The team uses a strain of mycelia that’s high in fibre, a complete protein source and also fibrous, a texture that helps the team create a muscle-like structure that closely mimics red meat.

Though the product is not yet available commercially, it’s set to launch into foodservice next year, says founder and CEO Pierre Dupuis. “We’re delighted to be in the UK food tech scene. It’s a very mature market with regards to meat alternatives, so there’s no need to educate corporates and consumers. They understand the need for these products.”

Hoxton Farms

Lab-grown animal fat that ‘looks & cooks like the real thing’ – with better ethics

Launched in 2020 by schoolfriends Ed Steele and Max Jamilly, Hoxton Farms grows animal fat – without relying on livestock. Designed to plug the shortfall in taste in many meat alternatives, the pair set about developing a cultivated fat that could ensure plant-based products would “look, cook and taste like the real thing”.

The team uses stem cells taken from pigs and cows and ferments them in a blend of plant-based nutrients – a little like brewing beer – so the cells multiply, grow and mature into fat. “Our innovative process brings together computational modelling and synthetic biology to grow animal fat from stem cells in patented reactors: a sustainable, scalable, cost-effective ingredient,” says Steele. “We then sell our cultivated animal fat as a B2B ingredient to food manufacturers.”

Last year, the startup opened its 14,000 sq ft pilot facility in London and expanded its senior leadership team. Though they’re yet to gain regulatory approval, the team has commercial co-development projects ongoing and will submit a regulatory dossier for its first product – a cultivated pork fat – later this year. “We [also] expect to receive approval in 2025 in the US and Singapore.”

Being based in the UK has been “hugely beneficial”, says Steele. It’s allowed the team to attract “world-leading talent”, remain close to top restaurants, influential chefs and investors, and operate at lower costs than if it were based elsewhere.

Impossibrew

Booze buzz without the alcohol: nootropic beer

Is it possible to ditch the alcohol but keep the buzz? Yes, says Impossibrew, a drink tech company set up by founder Mark Wong in 2021.

Using its Social Blend, a proprietary blend of nootropics, the startup says its non-alcoholic beers can promote relaxation in a similar way to alcohol, without the negative effects. Its beers also taste better than other low & no-alcohol alternatives, it says, due to an innovative brewing process that sees an undrinkable base liquid undergo cryogenic fermentation, creating a natural brew of up to 0.5% abv. This approach means the drink isn’t watered down, as no alcohol is removed.

It hasn’t faced some of the regulatory hurdles of other new concepts either, with its beer already commercially available.

Clean Food Group

‘An oilseed for the future’: solving the palm oil conundrum in food and cosmetics

Finding affordable and sustainable alternatives to palm oil remains a major challenge. But by using fermentation processes, the Clean Food Group, launched in 2022, believes it’s come up with the solution.

The team has created what it calls “an oilseed for the future”, which can be processed in exactly the same way as other agricultural oils, but which isn’t grown in a field. Instead, it’s made using a yeast cell grown vertically in a fermenter.

The technology was developed over eight years at the University of Bath, explains CEO Alex Neves, and is “crucially, scalable”, he says. “Our yeast is not genetically modified and can use a variety of carbon sources, including low-cost options such as food waste, which is critical in helping us bring down the cost of the end product.

“Our aim is to build the go-to sustainable oils and fats solutions provider to the food, cosmetics and petfood industries, solving three key industry challenges around sustainability, health and food security.”

It hopes to make the tech available to the food industry within the next three years, he says, with commercial products available as soon as next year in the petfood and cosmetics sectors thanks to lower barriers to entry.

The UK is the right place to be doing all this, says Neves. “I am constantly impressed and reassured the UK is at the forefront of such important work.”

Zya

Enzymes to convert sugar into fibre – after eating

Zya is taking the conventional approach to sugar reduction – reformulation and sugar substitutes – and flipping it on its head. It’s developing a food ingredient called Convero, an enzyme, that will convert up to 30% of sugar into fibre after eating.

“This means we can improve the nutrition of food at the point of digestion,” explains a spokesperson. The ingredient is produced using gene-edited microorganisms already found in the human microbiome, but which aren’t naturally produced at high enough volumes to make a meaningful impact.

Though not yet available commercially, the team is looking to partner with food manufacturers interested in adding its enzyme directly to food products such as bakery and chocolate.

Jux Food

NASA tech making dried herbs and powders as nutritious as fresh

Anna Wood was studying for an MBA when she first came across a NASA dehydration technology that had the potential to tackle the huge volumes of food waste caused as a result of perishable foods. Months of testing later, she launched Jux Food in 2023, a range of shelf-stable and 100% natural dried herbs, vegetable pieces and powders that retain 99% of the nutrition of fresh.

The team achieves this using a process called sublimation to remove water in fresh foods. Unlike traditional dehydration methods, which use heat, this process doesn’t destroy nutrition or flavour.

Since its November launch, Wood has already secured listings with 40 distribution points across the UK.

Flybox

The power of flies: insect farms that ‘feed’ on organic waste

While other startups focus on insects as a source of protein, Flybox is channelling its attention to insect farms that could help the industry take a more sustainable approach to food waste.

Its insect farms allow companies to ‘feed’ organic waste to insects bred in purpose-built bioconversion containers. The setup has the possibility to handle anything from small volumes of R&D waste to commercial-scale operations.

The approach “has lower CO2 emissions and offers greater financial returns when executed effectively in comparison to other waste treatment methods”, says co-founder Larry Kotch.

The technology is already available in the UK market, he adds.

No comments yet