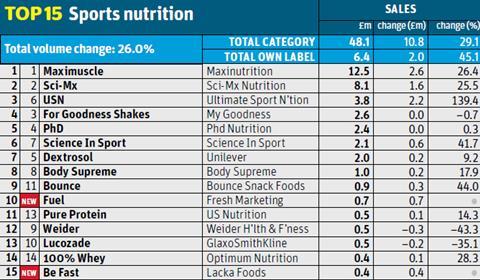

For a category hit by the imposition of VAT last October, sales of sports nutrition products look surprisingly healthy at first glance.

Volumes across the supermarkets have rocketed 26% over the past year and the top three brands have all enjoyed even higher levels of growth. Drill down further, however, and it becomes clear that the figures paint a somewhat flattering picture. Almost all the growth is coming from increased distribution rather than a higher rate of sale. Morrisons in particular has increased its range from a relatively low base and the number of facings for sports nutrition products across the top five supermarkets has increased by 20% year-on-year, according to Nielsen.

Furthermore, while value sales have increased by 29.1%, this is low considering VAT was added to sports nutrition products at the standard rate of 20%. Faced with the rising cost of key ingredients such as whey, the industry was forced to pass on the vast majority of the duty to consumers in the form of higher prices. This would imply that volumes increased by little more than 5.8%, but volumes actually rose 26% [Nielsen 52 w/e 12 October].

Read The Grocer’s full Top Products Survey.

The explanation for the mismatch is that the bulk of the large number of new facings this year was for smaller and cheaper products. Big tubs of protein can sell for more than £50, but the majority of this year’s listings were for considerably less expensive RTDs and bars.

The biggest brand in the market, GSK-owned Maxinutrition, is particularly downbeat about the imposition of VAT. “VAT has had a significant impact on the overall category,” says Maxinutrition UK & Ireland commercial director Craig Read. “In October 2012 many manufacturers, including Maxinutrition, had to pass on VAT. As a result we have seen a visible slowdown of category growth across all sectors of the business.”

Sales were especially poor in the weeks and months after VAT came in because a lot of consumers had stocked up in anticipation. Now, at least, most manufacturers agree that sales momentum is building back up again. “As expected, sales slowed in the last quarter of 2012 following the implementation of VAT, but the effect soon diminished as we entered the New Year,” says Trayl Wallace, managing director at SCI-MX.

“A greater challenge than VAT is the continued increase in raw material prices such as whey”

Richard Moore, Optimum Nutrition

Promotions have helped to bring consumers back to the category. One of the most popular mechanics has been to offer to pay VAT for the consumer by taking 20% off the sale price. Brands have also chosen to advertise discounts in monetary rather than percentage terms to underline the size of savings. However, they have been limited in what they can offer because of their own rising costs. Some key ingredients have rocketed in price in recent years, putting tremendous pressure on margins.

“The greater challenge (than VAT) is arguably the continued increase in raw material prices for core commodities such as whey protein,” says Richard Moore, commercial director for Northern Europe at Optimum Nutrition brand owner Glanbia Performance Nutrition.

Brands and retailers also turned to NPD in the wake of VAT to make sports nutrition products more affordable. For example, Holland & Barrett launched 250g own-label whey protein tubs in the spring (rsp: £10.99), considerably smaller and cheaper than the standard 900g or 1.2kg pack sizes, which retail for about £50, and it has own-label single-serve sachets under development.

These smaller packs sell particularly well in the supermarkets and other mainstream retailers because they are both more affordable and more approachable. The channel is seen as a point of entry into the sports nutrition category from which consumers may go on to buy larger products online or from specialists.

Moore notes that Optimum Nutrition’s Gold Standard 100% whey - which is a top seller in the US - has gained significant distribution at mainstream retailers, including Tesco and Boots, since the introduction of a more convenient 450g pack size.

Single-serve pre-mixes and bars also sell well in the grocers. These products have continued to perform since VAT and there is widespread confidence that they hold the key to the category hitting the big time.

“Alongside Maxinutrition Protein Milk, our Maxinutrition Meal Bars are also experiencing significant growth and we believe there is a huge opportunity, especially in grocery,” says Read. To illustrate the potential, brands often point to North America and Scandinavia - where protein drinks are commonly stocked alongside fizzy drinks and protein bars among the confectionery.

“Over the past year we have strengthened our distribution base in the mainstream grocery arena, securing additional locations within the main estates in Sainsbury’s and ASDA, commencing supply to Morrisons, and most recently, gaining further listings within the convenience sector in both Tesco and Sainsbury’s stores,” says Wallace. “This notable expansion of the category by grocers reflects the trend already seen in the mature US market where the sports nutrition category broadened rapidly into a mainstream position within just a few years.”

RTDs and bars are pitched as healthier alternatives to traditional sugary drinks and chocolate bars. Protein was one of the big winners from the new EU health claims regime that came into force last December, giving manufacturers the freedom to make strong claims in support of their products. Three protein claims related to growth in muscle mass, the maintenance of muscle mass and the maintenance of normal bones have been approved, and there is a good chance that others, potentially related to weght loss and satiety, may be given the green light before too long.

Some RTDs and bars are also not subject to VAT because the tax only applies to products that have sporty branding. For example, Maxinutrition’s new RTD Protein Milk is not VATable - it is marketed as “goodness for your muscles” rather than as a sports drink.

Conversely, For Goodness Shakes - which specialises in sports-branded RTDs that are all VATable - had a difficult time at the start of the year. The arrival of VAT in October stalled its negotiations with buyers about annual plans and delayed promotional plans as well as the launch of its new high-protein range.

Volume sales are down 20.5% year-on-year, but the outlook has improved considerably in recent months. In September, For Goodness Shakes celebrated completing a clean sweep of listings at all the big four supermarkets, having won new listings in Asda, Tesco and Morrisons over the summer.

“Our products are aimed at gym goers and sportspeople looking for ready-made shakes on the move so it wouldn’t have made sense for us to drop our sports positioning to bypass VAT. It is what differentiates us from other protein and milk drinks,” says For Goodness Shakes founder Jeremy Martin. “We’re pleased to report that our products are continuing to grow in popularity despite VAT. Our turnover in the last six months in grocery is up 34% and that’s before new distribution gains properly kicked in from September.”

If the new wave of more accessible sports nutrition products does take off in c-stores and supermarkets in a big way, it will be good news for the wider category and other retailers.

“The sports nutrition market is becoming more mainstream so the products need to be where the consumers shop,” says Moore. “This will also benefit specialist and independent retailers as new consumers will further engage with the category, seek out more knowledge and increase their overall regime.”

For the moment, VAT has definitely slowed growth in sports nutrition, but by continuing to push more accessible formats, the industry has a fighting chance of returning to its old growth trajectory.

Read The Grocer’s full Top Products Survey.

Top launch: Protein Milk Maxinutrition

Protein Milk is the biggest and most overtly mainstream launch from a sports nutrition brand this year. It has no sports branding so is not VATable. Instead it is positioned as a healthy, fat-free drink that is good for the muscles. GSK-owned Maxinutrition has splashed out £1m on a media campaign, including a big outdoor ad push and sampling to 80,000 consumers. Launched this summer, it is too early to gauge sales success, but Protein Milk has won listings with Tesco and Sainsbury’s.

No comments yet