As its user base balloons, should brands risk getting involved?

The rise of Chinese cut-price marketplace Temu in the UK has been meteoric. Its highly gamified, promotions-plentiful app – which promises users the chance to “shop like a billionaire” – was among the fastest-growing in the UK last year, according to Similarweb. Its monthly active users increased by 53% year on year, to more than 9.9 million.

So, with such a fast-expanding user base, what opportunity does Temu represent to fmcg suppliers and brands?

Temu’s marketplace covers a broad range of categories, with products shipped directly from Chinese manufacturers to avoid the cost of intermediate distributors. While products are cheap, the downside for consumers is the weeks it takes for orders to arrive. To counter this, since last year, Temu has been inviting UK merchants to join the platform “to widen the range of local products and reduce delivery time”.

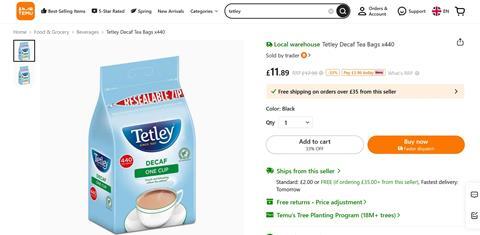

The UK’s “local sellers” are already shifting brands including Tetley teabags, Candy Kittens sweets, Fanta and Fairy Liquid. Thus far it’s primarily resellers and wholesalers offering branded products, with better-known brands yet to sell direct. Unlike on Amazon, there is no opportunity to build branded storefronts.

“I can definitely see this happening in the future,” says Greg Zakowicz, senior e-commerce expert at Omnisend. “However, we are still a while away from seeing this come to fruition. The perception of knock-off products and low infringement enforcement on the platform will slow adoption.”

But some manufacturers are already seizing what one called the “still largely untapped potential”. UK-based toilet paper and kitchen roll manufacturer Nova Tissue had been seeking new sales channels after the large retailers and wholesalers it had supplied “began demanding lower prices while tightening their grip on the market” says Nova MD Khurram Iqbal.

Nova started listing its products on Temu in December. Almost immediately, daily sales surpassed £10,000, and several lines became UK bestsellers.

“Once we started to sell on Temu, we realised the sales volumes are huge. The potential is massive,” Iqbal says.

Temu’s margins are “significantly more favourable” and the cost of selling on the platform lower than rivals, he adds.

Get involved

So how long can a big brand ignore Temu’s rise? Chances are there is a rival, low-priced, generic equivalent product already listed there, and turning up in Google searches.

“Considering that Temu uses its vast digital marketing budget to advertise its unbranded goods by bidding against the trademarks of many UK household-name brands, where Amazon does not, it makes sense that if they can’t beat Temu at the search stage, they’re better off selling through it,” says e-commerce expert Miya Knights.

However, Temu’s relentless focus on lowest prices will be “the challenge in recruiting reputable brands to sell on its platform, and likely the reason there are so many imitation products on the site” says Zakowicz. “Brands have a business interest in price control, allowing them to maximise profits without devaluing their product or brand name. This is in direct conflict with Temu’s low-price value proposition.”

Nevertheless, amid the cut-price, Chinese products, brands that are “highlighting authenticity, innovation, superior craftsmanship and brand narrative” can “stay ahead of imitators” Knights adds.

And though it has been accused of selling dupes and copycats, Temu says “unlike other platforms where third-party resellers can quickly flood the market with competing listings”, it “provides safeguards to ensure manufacturers retain control over their products”.

For now, Temu’s reputation counts against it, argues Zakowicz. “Temu will be an outpost for the industry rather than a destination for food and drink goods,” he says. “People are a lot more wary about what they eat and drink than what they wear or use around the house.”

But in certain categories, it is a channel that is increasingly impossible to ignore. Temu says it expects 50% of UK sales to come from local sellers and warehouses by the end of this year.

“I don’t think the mainstream public has really grasped Temu yet,” Iqbal says. “If this is what it can do now, then I’m really excited as to where it might be in three, four years.”

![XOXO-Product-Shot[ALL FLAVOUR]-Sky-1920x1080](https://dmrqkbkq8el9i.cloudfront.net/Pictures/274x183/4/9/2/355492_xoxoproductshotallflavoursky1920x1080_806584_crop.jpg)

No comments yet