Lately, there has been a notable step-up in mainstream media coverage of the potential health risks associated with ultra-processed food (UPF). Two large-scale studies in 2023 presented at the European Society of Cardiology highlighted meaningfully increased risk of heart attack and strokes from diets high in UPFs, controlling for the nutritional profile of the diet (i.e. levels of sugar, salt and fat).

The US, the UK and Canada lead the world in UPF consumption, with 57%, 56% and 48% of total calories derived from UPFs respectively, according to the most widely used Nova definition. The level in other developed markets, such as Italy, is much lower at 18%.

Ultimately, there is a debate over how much of a threat UPF concerns pose to the structural growth prospects of the packaged food industry. In the US, the overall food industry is outperforming packaged food, suggesting more scratch cooking and more consumption of minimally processed foods such as fruit & vegetables, meat & fish and fresh dairy.

The GLP-1 link

Whether the US trend is a boost from GLP-1 patients switching to healthier diets, or a reflection of the rocketing prices of US packaged food in recent years, is unclear. What is clear is that the volume recovery many food companies had been expecting to see by now has been slower, and the reasons seem to be eluding many in the c-suite.

Gut health and protein are the two food categories gaining the most traction in this push for healthier products. GLP-1 usage is said to have muscle wastage side effects, so consumers are looking to compensate in their diets with higher-protein products – which could boost this consumption basket. Indeed, users of GLP-1s are more likely to make healthier choices in their daily lives.

The food industry has been watching for signs that GLP-1 penetration is impacting consumer behaviour, but very few have admitted to it so far. While overall usage of GLP-1 drugs remains relatively low in the US, and demand is still outweighing supply, things might be about to change. A new, more powerful generation of weight-loss drugs could significantly boost growth and supply could soon increase.

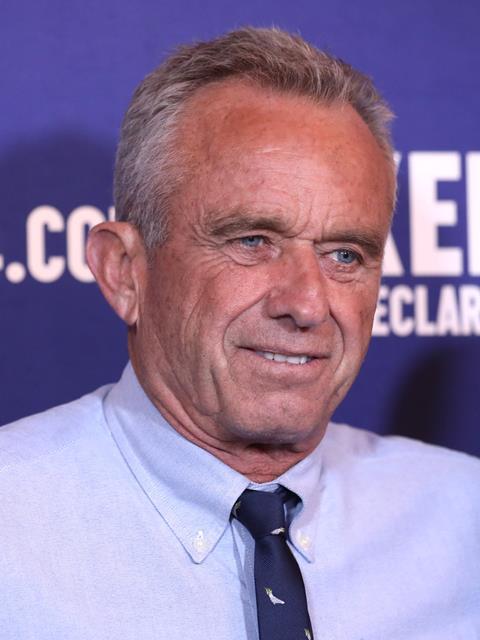

Appointment of RFK Jr

This topic of UPFs is moving into sharper focus given that Robert F Kennedy Jr, the proposed health & human services secretary for the incoming Trump administration, has been a vocal proponent of reducing their consumption in the US to combat increases in obesity and diabetes.

One tool he’s highlighted is the Special Nutritional Assistance Programme (SNAP), which could be used by the federal government to bring about a decline in UPF consumption. It provides over $100bn of welfare to lower-income households to fund food purchases.

RFK Jr argued SNAP should not be used to fund processed food. He pointed out 9% of all SNAP funding goes to sweetened drinks, and said it was nonsensical for US taxpayers to spend tens of billions of dollars subsidising ‘junk’ food that harms the health of low-income Americans. A complete ban on UPF under SNAP could prove challenging, as the definition of UPF is still relatively vague from a policy-making perspective.

Alex Sloane, Barclays Research’s ingredients analyst, has argued it might be easier for RFK Jr to improve American diets by promoting front-of-pack labelling requirements, in a similar vein to Latin America. Interestingly, this seems to be a direction the FDA is now moving in.

This week, the FDA proposed a front-of-pack warning label for foods based on relative amounts of sodium, saturated fat and added sugars. It would complement the nutrition facts label that is already required on most packaged food. The proposed rule would establish a compliance date of three years after the final rule’s effective date for businesses with $10m or more in annual food sales.

Putting it all together, it looks like the US is starting to move down the path Europe has been moving in for a while. The ‘MAHA’ (make America healthy again) tagline is trending. The proposals from RFK Jr and the FDA, combined with the increased interest from consumers on the topic of health, mean food CEOs will need to stay ahead of the curve.

It is certainly not all negative, and this should be seen by management teams to be as much an opportunity as a threat as we head to a lower-calorie, higher-value future. New winners will be be those that adapt to stay ahead of the consumer and regulation.

No comments yet