Guinness Draught has moved past John Smith’s Extra Smooth to become Britain’s biggest brand within the ale & stout category.

In the past year, Diageo’s Guinness Draught brand saw £3.3m added to sales, taking its value to £69.1m, nudging the stout past John Smith’s Extra Smooth ale. The Heineken brand declined 2.1% to £68.5m – a £1.4m loss [Nielsen 52 w/e 8 October 2016].

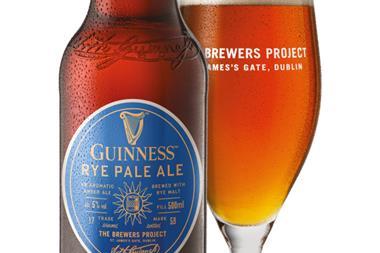

Diageo said Guinness Draught had managed to tap the UK’s growing thirst for craft booze by pushing the Irish brew’s “story, provenance and ingredients”.

“Consumer excitement for products created with craftsmanship and character has brought a new energy into the world of beer,” said off-trade sales director Guy Dowdell. “There continues to be an inescapable excitement.”

Heineken did manage to slow the decline in John Smith’s sales compared against 2015, when it saw £4.3m wiped off its value – a 5.7% drop [Nielsen 52 w/e 10 October 2015].

The clawback was the result of “increased investment, an updated look, new ads, and a digital campaign”, said Heineken’s off-trade category & trade marketing director, Craig Clarkson.

However, John Smith’s was the only of the top five brands in the ale & stout category to suffer sales losses last year. Overall, the category saw value sales surge 5.1% to £674.7m.

It wasn’t all good news for Diageo, with Guinness Original slipping to sixth spot, passed by Sharp’s Doom Bar, as value fell 2.4% on volumes down 12.5%.

The real success story in the overall category was arguably BrewDog, which saw its flagship Punk IPA nearly treble sales from £6.2m to £16.1m, propelling it to seventh spot in this year’s Top Products review, as it continued to ride the craft wave.

No comments yet