As the UK economy struggles through multiple shocks, discover how food manufacturing businesses are using the latest technology to manage their risk and ensure they’re not affected by the financial distress of others.

Food manufacturing has been one of the sectors hit hardest by the UK’s struggling economy. Years of successive economic shocks and changing consumer buying habits have created a perfect storm of insolvencies within the industry, leading to a 102% rising in insolvencies year on year from 2022 to 2023.

Business data specialists Red Flag Alert report that 3,250 food manufacturing companies are in financial distress, 362 of which are at serious risk of collapse.

Factors effecting the UK

The industry’s troubles began due to Brexit, which not only made doing business with Europe more difficult but also imposed costly and complex changes to regulations and operations, which left it especially vulnerable to the macroeconomic pressures caused by and following COVID.

As an industry with a high energy usage, the energy bill shock caused by the war in Ukraine has been keenly felt, as was the UK government’s relative lack of support with business energy bills in comparison to other G7 countries. The war in Ukraine further affected food manufacture by throttling grain supply and leading to a sharp increase in prices.

It is not just the supply of grain hampering the industry, global supply chains are yet to recover from COVID and almost all food manufacturers will have experienced trouble procuring resources and experienced increased prices as a result. Rising costs were further exacerbated by the UK’s soaring inflation and a sharp increase in interest rates.

Consumers’ wallets have also felt the effects of these and many consider the country to be in the midst of a cost of living crisis. Increased frugality in the British public means that premium food products are now less attractive and buying habits have shifted significantly towards cheaper options.

To attract today’s financially conscious consumers, UK supermarkets are currently engaged in heated price wars, in which they pressure suppliers to keep prices low. Being unable to adjust prices inline with costs means that industry margins are at their lowest in recent years and leave companies vulnerable to any further financial shocks.

As these factors take their toll, both in terms of industry insolvencies and weakening surviving companies, they contribute to the rising threat of bad debt within the food manufacturing sector.

Identifying food manufacturers at risk of failure

When a company goes insolvent, its creditors must then absorb that bad debt and interruption to their cashflow, which is obviously significantly more difficult in times of economic hardship.

Each of these creditors that fails themselves then places pressure on their own creditors and thus insolvencies caused by bad debt can be seen to travel in a ripple effect. Statistics show that a company that suffers a bad debt is three times more likely to go insolvent themselves.

The chain of bad debt within a sector continues until it reaches companies that are able to absorb the loss and thus break the chain. Usually these are larger, high turnover companies. Unfortunately the industry has already seen large insolvencies, such as Orchard House which collapsed owing £57 million, £9 million of which was owed to its employees.

Red Flag Alert’s data is showing that that there are numerous high turnover food manufacturers that are showing signs of serious business distress and present a credit risk.

Examples of signs our experts look out for include: Lateness in submitting most recent set of financials. Delays in submitting results are often associated with business distress and potential credit risk.

And manufacturers showing strong turnover growth for several years but profits failing to grow in proportion. Sometimes this leads to a winding up petition being submitted and eventually withdrawn against them. These two factors imply business distress and credit risk.

What is the solution?

Despite the difficult business environment facing food manufacturers, there are many things that directors can do to protect their business. An important one is practicing excellent credit risk and supply chain management.

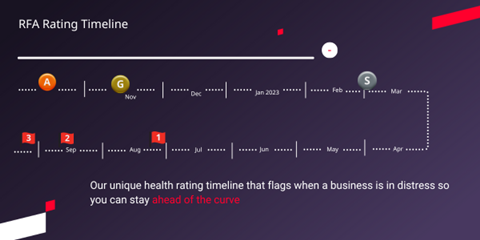

By leveraging technology in the form of a business data and credit check platform you will be able to gain an in depth understanding of a potential customers financial health and creditworthiness. You will also be able to then monitor those clients for early signs of financial instability.

As we wait for economic conditions to settle and become more amenable to doing business, avoiding bad debt and failed suppliers you will give your business the best chance of not just surviving but thriving.

Several food manufacturing businesses use Red Flag Alert to manage their risk and ensure they’re not affected by the financial distress of others. Sign up for a free trial or find out who we’re predicting will go insolvent next by accessing our company report

Find out more about a free trial with Red Flag Alert.