Consumers are becoming less inclined to make special efforts to curb their grocery spending, a new study of 1,000 UK consumers finds.

The last few years have been characterised by cutbacks, but with UK inflation hitting its lowest level since 2021 in February, consumer behaviour is changing [Financial Times]. Consumer research firm Attest, which has been tracking food and beverage shopping and spending habits for five years, has noted a distinct decline in consumer cost-cutting as we close out 2024.

The data shows that Brits aren’t shopping around to the same degree they were a year ago. In 2023, 59% of consumers said they were ’very likely’ to shop around to get the best deals on groceries. Today, that figure has fallen to 39% [Attest].

This change is reflected in shoppers’ supermarket preferences. German discounter Aldi has registered a -12 percentage point decline in habitual shoppers since 2022 (to 14%), while Sainsbury’s has chalked up growth of +8 percentage points (to 15%) [Attest].

New opportunities for premium brands

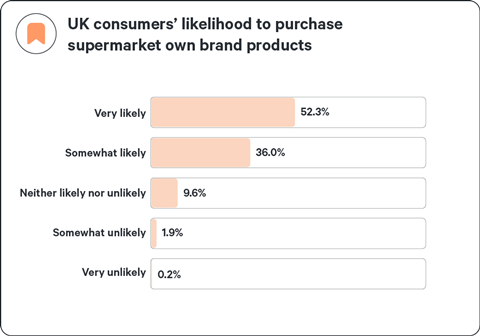

Own-brand benefited hugely from the cost-of-living crisis. In 2022 – when UK food and drink prices rose at the fastest rate since 1977 – more than half of consumers said they had increased their purchasing in the category (while 74% were shopping less in the premium/luxury foods segment). But Attest’s most recent data shows Brits are becoming less likely to purchase own-label products.

Since last year, the percentage of consumers who state they are ‘very likely’ to purchase them has declined by -8 percentage points (to 52%). This finding is in line with data from 2023 which showed that only 26% of shoppers would definitely stick with supermarket brands if price wasn’t an issue.

The research suggests that UK consumers are, once again, putting a greater emphasis on quality. When asked to rank the factors that influence them when choosing food or drink brands at the moment, 33% ranked ‘quality/taste’ in first place, compared with only 22.5% a couple of years ago.

At the same time, the influence of price has declined: in 2022, 58% ranked ‘price’ as their first priority, versus 47% today. With shoppers becoming less price-sensitive, sales of trusted household brands are likely to increase. Meanwhile, there are opportunities opening up for newer brands and products with a focus on high-quality ingredients.

Baskets are changing

The economising that took place due to the high cost of living not only extended to buying cheaper brands; it influenced the very diet of the British consumer. From buying cheaper cuts of meat, to forgoing meat altogether, 51% of shoppers were buying cheaper types of food in 2022. And more than a third of Brits were trying to save money by simply buying less food.

Both of these behaviours have declined significantly; only 22% of consumers are actively trying to limit the amount of food that they purchase, while 36% say they are bulking out their baskets with cheap foods. The data also shows increased meat consumption.

The flexitarian diet – where people eat a minimal amount of meat – has declined in popularity by -8 percentage points since its peak (to 16%). In total, only 25% of UK consumers are following a meat-free or meat-reduced diet (down from 37% in 2021). It could be that some people had adopted these diets as an austerity measure.

Food provenance is becoming important again

When inflation was at its highest, where food came from and how sustainable it was became far less important to consumers than how much it cost. As a result, the percentage of Brits buying locally produced food and drink, or buying from environmentally friendly brands plunged. Today, we’re starting to see those trends recover.

Buying locally produced products has increased by +10 percentage points, and is something that 41% of consumers actively try to do. Purchasing from green F&B brands – something that usually incurs a premium – has risen by +5 percentage points (to 27%). Buying in-season produce is also trending; 42% of shoppers endeavour to buy food that has not been imported from distant locations with different climates.

Brands can also expect to see increased consumer interest in ingredients and food additives in 2025. Awareness of ultra-processed foods (UPFs) is growing, with 11% of Brits believing it to be the key issue for the food industry to tackle, and nearly 30% of consumers trying to cut down their intake. Sugar content also remains a hot topic, with half of shoppers striving to reduce their consumption.

2025 – a year for growth

As the year comes to an end, the outlook for 2025 appears optimistic. Providing the economy remains stable, Attest’s consumer trends data suggests next year could be a period of growth for F&B brands. However, carrying out research to understand your target consumers at this time of change will be crucial to maximising the opportunities.

Get Attest’s 2025 F&B Trends Report here.