If you’re looking for a casualty from the war on sugar, you’ve found it. While carbonates, energy drinks and sweets escaped relatively lightly, juices & smoothies have been hammered.

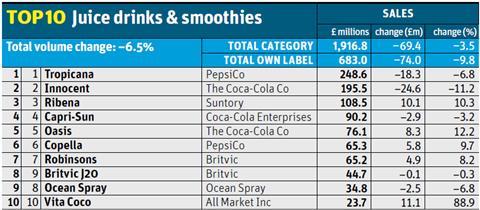

Value has slumped £69.4m (3.5%) on volumes down 6.5%, with own label’s long-term decline gathering pace to nearly double the rate of a year ago. Overall, brands have fared better, with value up 0.4% and volumes down 3.2%, but some of the category’s biggest players – including Tropicana and Innocent – have suffered devastating losses.

Admittedly, the worst of the damage to brands’ top lines was offset by brand owners successfully pushing through price increases and scaling back on the fierce promotions the category has seen in recent years. Volume sold on deal for Tropicana and Innocent has declined 14% over the past year, says Nielsen.

It’s further down the best-sellers where the real good news stories are. Oasis defied the decline thanks in part to a TV campaign kicking off in April to mark the brand’s extension into water enhancers and the new Pineapple Rush variant. Its relative strength in the convenience sector also helped. Copella has turned in value growth of 9.7% on volumes up 9.5%, partly by keeping a tight lid on prices as average prices across the category grew 3.2%.

But the real excitement is even further down the list, as brands that offer healthier, less calorific alternatives to fruit juice boom. Coconut water brand Vita Coco almost doubled value sales, thanks to NPD, a host of new listings, marketing focused on its nutritional benefits and celebrity endorsements (Rihanna is the brand’s poster girl). Tropicana’s low-sugar, stevia-based juice drink Trop 50 is up 16.1%.

Clearly, brands can no longer afford to ignore the fallout from the war on sugar. “Consumers today are becoming more health conscious in terms of food and drinks,” says Georgina Thomas, category director at Lucozade Ribena Suntory. “It is the role of the manufacturers, as well as the government, to focus on greater education and further encouragement around consumption occasions as part of a balanced lifestyle.”

Hence the raft of ‘healthier’ and functional NPD we’ve seen of late. In April, Innocent launched a range of ‘super smoothies’ packed with fruit & veg and supplemented with seeds, botanicals, vitamins and minerals. “Over the next couple of years, retailers will be going through quite a lot of change, as consumers become more demanding of variety in having a drink either more nutritionally dense or less calorific to better meet their wellness needs,” says James Davenport, UK FD at Innocent, adding that veg juice is a particular opportunity. “People want nutritional support and easy shortcuts. A Mintel report revealed that 38% of people felt that if a drink contained vegetables it would be better for them,” he adds.

Innocent followed this up in October with its first foray into cold-pressed drinks, another growing market (see below).

Don’t rule out conventional juices altogether though. On-the-go oriented innovation could prove valuable in coming years, says PepsiCo marketing director Adrian Baty: “Currently only 2% of on-the-go breakfasts contain juice, which means there is still a real opportunity to unlock phenomenal growth.”

Vimto UK marketing manager Emma Hunt agrees, but sounds a note of caution on returning to the high levels of promotion of recent years. “Shoppers are increasingly savvy , choosing to shop around for the best deals,” she says. “Health, convenience and the need for added value beyond pricing will continue to be an ongoing focus.”

Top launch: Super Smoothies by Innocent

Innocent has big ambitions for the functional fruit & veg drinks it launched in March – setting out a two-year sales target of £30m. There’s no denying Super Smoothies is a compelling proposition – combining the strength of the Innocent brand with good-looking products featuring fruit, vitamins and ingredients such as flax seeds and wheatgrass. And the range has got off to a super start, with the 360ml bottles introduced at launch joined by 750ml take-home cartons six months later.

No comments yet