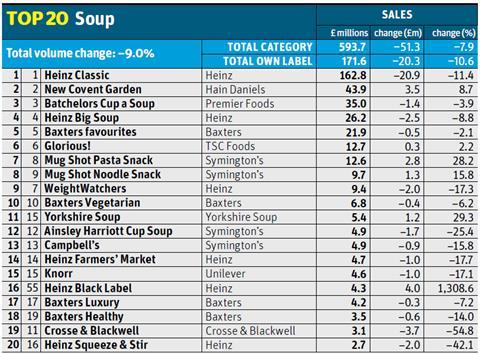

Soup is in hot water. A mild winter and hot summer have dragged both value (-7.9%) and volumes (-9%) down. Brands in the crowded chilled soup sector have been hit particularly hard, with value draining away as they’ve gone head-to-head with own label, while canned market leader Heinz Classic has haemorrhaged £20.9m. Volumes fell 7.7%.

There are still a few reasons for cheer, however. Since returning to Tesco a year after its October 2012 delisting, a move that boosted own label’s performance in last year’s Top Products survey (it was up 16.1%), New Covent Garden has added £3.5m to its top line on volumes up 13%, with most of the growth coming from the brand’s new Skinny range.

The brand’s efforts to tap the trend for more exotic flavours, with variants such as Goan Spiced chicken and Quinoa & Turtle Bean proving popular, appears to have aided its recovery too. Despite the decline of the Classics range, it is also paying off for Heinz, which has racked up £4.3m in the past year with its premium Black Label range since launch in August 2013.

Heinz says it has been able to achieve these results by building on the popularity of its core Classics brand and offering an “irresistible” alternative take. “The twists provide a modern, premium and flavoursome addition,” says a spokesman. So Cream of Tomato was given a makeover with Fiery Mexican Spices or A Kick of Chilli, and Aromatic Thai Spices added to Cream of Chicken.

Heinz has not been doing as well in instant soup. The Squeeze & Stir range it launched in 2012 has suffered a whopping 42.1% decline in the past year as Symington’s line up of soup/meal crossovers under the Mug Shot brand went from strength to strength by going after the lunchtime market. Heinz is looking to claw back some share following the July launch of a cup soup range.

As brands for the most part slug it out among themselves in ambient, own label is more of a force to reckoned within chilled. “Rather than just following and replaying the recipes of the branded manufacturers, retailers have been developing their own,” says Jeremy Hudson, CEO of New Covent Garden owner Hain Daniels Group, pointing to the retailers’ premium own label lines.

Indeed, there’s no shortage of innovation under own label. For example, the Tesco Finest range includes Red Thai Chicken and Sweet Potato, Coconut & Chilli soups; Asda’s Extra Special includes Spanish Chorizo & Butterbean and Wild mushroom varieties. Still, Hudson is confident Covent Garden can continue to grow through innovation.

Trouble is, next year Covent Garden’s figures won’t be flattered by a relisting at Britain’s biggest retailer. There’s no guarantee the weather will play ball either.

NCG single serve Hain Daniels

Covent Garden’s new Skinny flavours, such as Kale & Nutmeg and Vegetable & Supergrain (launched in September), are good, but not exactly game-changing. But its launch of 320ml single-serve pots a month later might just be.

The new format is aimed squarely at the lunchtime market and those put off by the size of the category standard 500ml format. It might also make those sad, half empty cartons of soup that fester at the back of the fridge a thing of the past too. Here’s hoping…

No comments yet